How our crypto exchange comparison works

Our goal is to help you find the best crypto exchange for your needs. While many platforms may look similar at first glance, a closer look often reveals significant differences in focus, functionality, and ease of use. We highlight these strengths and weaknesses directly in our comparison table.

Key strengths highlighted in our comparison

Regulated exchange: Licensed in a major jurisdiction such as the EU (MiCA), US (FinCEN, BitLicense, SEC), UK (FCA), Singapore (MAS), or Japan (FSA). Offshore registrations do not qualify.

For traders: Well suited for active trading, offering advanced features like order books, multiple order types, charting tools, leverage, and competitive fees.

Low fees: The platform scored 9 out of 10 or higher in our fee rating.

High security: The platform scored 9 out of 10 or higher in our security rating.

Easy to use: The platform scored 8 out of 10 or higher in our usability rating.

Many features: The platform scored 8 out of 10 or higher in our features rating.

Key weaknesses highlighted in our comparison

No US access: Not available to US users due to regulatory restrictions. Some platforms offer a limited US version.

No real crypto: Only offers financial products (CFDs, ETPs, ETNs) instead of actual cryptocurrencies.

No wallet transfer: Crypto cannot be withdrawn to an external wallet.

High fees: The platform scored 6 out of 10 or lower in our fee rating.

Poor customer support: The platform scored 6 out of 10 or lower in our support rating.

Not for beginners: The platform scored 6 out of 10 or lower in our beginner-friendliness rating.

Limited coin selection: The platform offers 50 cryptocurrencies or fewer.

Low review count: The platform has fewer than 1,000 external user reviews across Trustpilot, Apple App Store and Google Play.

Popular crypto exchange features compared

Recurring purchase (DCA plan)

Staking

Real crypto

Self-custody

Trading tools

Our evaluation criteria

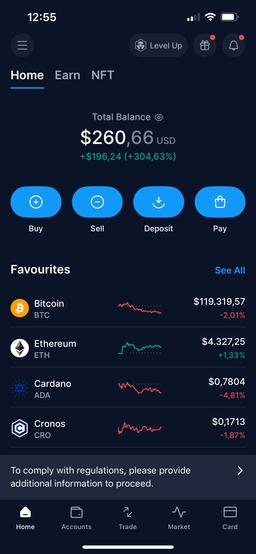

Usability: Simple onboarding, intuitive interface, easy access to key features.

Features: Breadth of tools and functions; note that more features can mean more complexity.

Fees: Includes maker/taker fees, spreads, and any hidden charges (e.g., deposits, withdrawals).

Security & trust: Jurisdiction, licenses, audits, transparency, reputation, and track record.

Beginner-friendliness: How accessible the platform is for newcomers.

Support: Quality and responsiveness of customer service, based on our tests and user feedback.

About the author

Hi, I'm Philipp. 👋

Founder coinbird.com

With over 15 years of experience in the IT sector, I love building easy-to-use digital products that actually help people. In 2017, I fell down the Bitcoin rabbit hole and gradually realized that the crypto world lacked simple, user-friendly tools for everyday people. That’s why I created coinbird.com – to make crypto easier to understand, more accessible, and transparent.

LinkedIn