Best crypto trading platforms

Crypto trading is more popular than ever. But choosing the right platform or app isn’t always easy. From fees and features to security and leverage options — there’s a lot to consider before you start. In this guide, we’ll walk you through the best crypto trading platforms and apps available today and help you find the right one for your needs.

Table of contents

At a glance

Bitget ranks as the best overall crypto trading platform thanks to its extremely low fees, wide selection of coins, and powerful trading tools. If you’re looking for an established platform with a long track record, Binance and Kraken are also strong choices.

Top 5 crypto trading platforms compared

Recommended trading platforms

Bitget: Popular trading platform with the lowest fees and widest range of coins.

Kraken: One of the most trusted and established crypto exchanges.

Binance: The world’s largest crypto trading platform by volume.

OKX: Great all-rounder with a optional beginner-friendly interface but also advanced trading tools.

KuCoin: Exchange with a large selection of tradable altcoins.

Bitget: Our top-rated crypto trading platform

With a score of 8.2 out of 10, Bitget takes the top spot in our crypto trading comparison. It impressed us with its clean trading interface, robust tools, wide coin selection — and some of the lowest trading fees on the market, starting below 0.1%.

What is crypto trading?

Crypto trading is the strategic buying and selling of cryptocurrencies to profit from price fluctuations. This can include spot trading, derivatives, and the use of technical indicators.

If this sounds complex, don’t worry — we’ll break it down step by step.

Choosing the right trading platform

Your choice of crypto trading platform forms the foundation of your trading experience. While most platforms may look similar at first glance, there are important differences in features, fees, and security.

What to look for in a trading platform:

Security: Look for platforms that offer two-factor authentication (2FA), cold storage for crypto assets, and modern encryption. Some even provide insurance in case of hacks.

Fees: Trading fees can significantly impact your returns. Some platforms charge flat fees, others take a percentage per trade. Don’t forget hidden fees like withdrawal charges.

Available assets: Not all platforms offer a wide range of coins. If you want to trade altcoins beyond Bitcoin and Ethereum, check which assets are supported.

Order types: For advanced strategies, your platform should support limit orders, stop orders, and trailing stop orders.

Regulation: Platforms that are regulated by financial authorities generally offer more transparency and protection.

Customer support: A responsive support team can be crucial. Look for platforms that offer live chat, email, or even phone support.

Leverage and margin trading: If you plan to trade with leverage, check the maximum ratio offered and what risk controls are in place.

Spot vs derivatives markets

There are two main markets in crypto trading:

Spot market: You buy and sell actual cryptocurrencies.

Derivatives market: You trade contracts that represent the price of an asset, without owning it. This includes instruments like futures, CFDs, and options.

Crypto trading analysis

There are two primary methods of analyzing the market:

Technical analysis: Uses charts, indicators, and price patterns to predict future movements.

Fundamental analysis: Looks at a coin’s underlying value — such as its technology, team, and market demand.

See also: Our crypto analysis checklist

Popular crypto trading strategies

Crypto trading is a complex endeavor that depends heavily on both market knowledge and the use of effective strategies. Below is an overview of some of the most commonly used strategies in the crypto space — including their strengths and weaknesses.

Fundamental analysis

Day trading

Swing trading

Scalping

Momentum trading

Mean reversion

Each strategy has its own set of benefits and drawbacks. It’s important to choose the one that fits your risk profile, trading goals, and market understanding.

Many experienced traders also combine multiple strategies to diversify risk and improve their overall results.

Disclaimer: This article does not constitute financial advice. Always do your own research and use proper risk management.

Long, short, and leverage trading

As you explore crypto trading platforms, you’ll often come across the terms “going long,” “going short,” and “leverage trading.”

These concepts are essential to understanding the different strategies you can use when trading cryptocurrencies.

Long position

Going long means buying a cryptocurrency with the expectation that its price will rise. If you’re “long,” you profit when the price goes up. This is the most basic and widely used trading strategy — and typically the first one new traders learn.

Short position

Going short is the opposite of going long. In this case, you speculate that a cryptocurrency’s price will go down. To do this, you borrow the asset, sell it immediately, and later buy it back at a lower price to return it to the lender. Your profit comes from the difference between the selling and repurchase price.

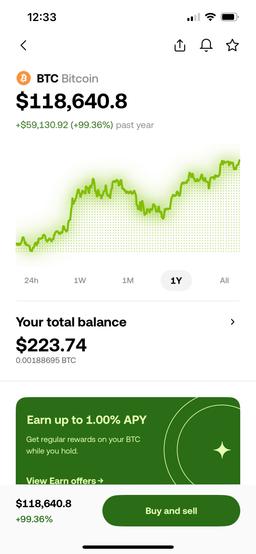

Leverage trading

Leverage trading allows you to control a larger position with less capital by borrowing funds.

For example, a 30x leverage means you can open a $3,000 position with only $100 of your own money.

While leverage increases your potential profit, it also amplifies your risk — losses can grow just as quickly.

Important note:

Trading derivatives like CFDs, especially with leverage, is highly risky and should only be done by experienced traders. Always use proper risk management and make sure you understand all the risks involved.

Risk management in crypto trading

Risk management is a crucial part of crypto trading — and one that’s often overlooked. But make no mistake: effective risk management can mean the difference between long-term success and quickly losing your capital. Here are some practical strategies and tools you can use to protect your portfolio:

Capital allocation

Only invest risk capital: Never trade with money you can’t afford to lose. Your crypto trades should only represent a small portion of your total financial portfolio.

Position sizing: Decide in advance how much of your capital you’re willing to risk on a single trade. A common rule is to risk no more than 1–2% of your total trading capital per position.

Stop-loss and take-profit

Stop-loss orders: These automatic orders sell your crypto if the price drops to a certain level. They’re essential for limiting losses and protecting your capital.

Take-profit orders: Similar to stop-loss orders, but in the other direction: if the price hits a predefined higher level, the position is closed to lock in gains.

Diversification

Asset diversification: Spread your investments across multiple cryptocurrencies rather than putting everything into one. Each asset has its own risk profile and volatility.

Strategy diversification: Use a mix of trading strategies and timeframes. Some strategies work better in bull markets, others in bear markets — diversify to reduce risk.

Psychological risk management

Emotional discipline: Mastering your emotions is key. Impulsive decisions often lead to poor trades and unnecessary risks.

Trading journal: Document all your trades, strategies, and emotions. Reviewing your history helps you learn from mistakes and refine your approach.

Risk-to-reward ratio

Before entering a trade, always evaluate the potential reward relative to the risk. A minimum ratio of 1:3 is generally recommended — meaning your potential profit should be at least three times larger than your potential loss.

Market analysis and news

Economic calendar: Keep an eye on major events that could move the crypto market. Regulatory news or macroeconomic shifts can trigger sharp price changes.

Technical indicators: Use tools like the Relative Strength Index (RSI) or moving averages to identify overbought or oversold conditions — both of which can carry increased risk.

Order types in crypto trading

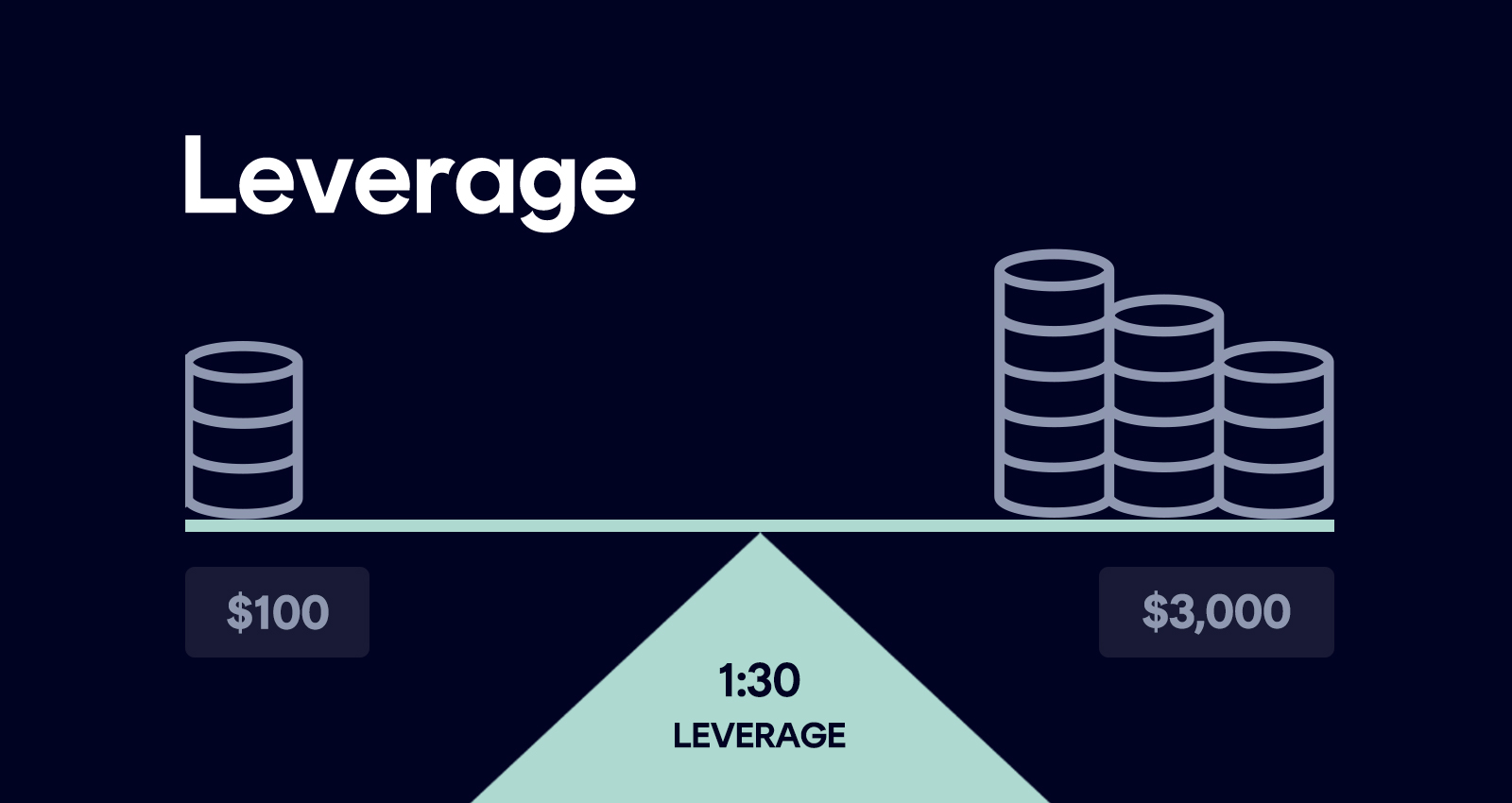

In crypto trading, an order is an instruction sent to an exchange to buy or sell a digital asset. There are several types of orders, each designed for different strategies and market conditions.

Here are the most important and commonly used types:

Market order

Limit order

TWAP order

Stop-loss order

Market order

A market order is the most straightforward and widely used order type. It is executed immediately at the best available price. Traders often use market orders to quickly buy or sell cryptocurrencies for USD (or other fiat currencies). You simply select the trading pair, direction (buy or sell), and the amount — and the order is filled instantly.

Limit order

Limit orders are similar to market orders but not executed immediately. With a limit order, you set the worst price you’re willing to accept — either the highest price you’re willing to pay (for a buy order) or the lowest price you’re willing to sell at (for a sell order). If the market reaches that price (or better), the order is automatically filled. If not, the order remains open until it’s filled or expires. That’s why limit orders often include an optional expiration date.

TWAP order

TWAP stands for Time-Weighted Average Price. This order type is used when investing larger amounts and helps minimize market impact. TWAP automatically splits your order into smaller market orders and spreads them out over a set period of time — aiming to achieve a stable average entry price.

Stop-loss order

A stop-loss order is designed to limit potential losses. It is triggered when the price of an asset drops to a specified level. You set the price at which the asset should automatically be sold — effectively placing a safety net under your position. Stop-loss orders are especially important for managing downside risk in volatile markets.

How to learn crypto trading

Summary

To learn crypto trading, start with the basics — including key terms and concepts. Use online courses, webinars, and books to build your knowledge. Practice with demo accounts, explore technical analysis, and stay informed with current news.

Learning how to trade crypto is not a sprint — it’s a marathon. Here are some concrete steps to help you build a strong foundation:

Do your research

The first step is understanding the core principles and terminology. Make sure you’re familiar with concepts like:

Trading pairs (e.g., BTC/USD)

Order types (e.g., market, limit)

Technical indicators such as moving averages and RSI

There are plenty of online resources, including webinars, video tutorials, and in-depth guides to help you get started.

Master technical analysis

Technical analysis is the backbone of crypto trading. It involves studying price charts and trading volume to predict future trends.

Before placing any trades, take time to read the chart of the cryptocurrency you’re interested in. Look for common patterns like head and shoulders or support and resistance zones — they can help you identify entry and exit points.

Practice with real tools

Theory is great — but nothing beats real-world experience. Once you’re comfortable with the basics and technical tools, it’s time to get hands-on. Start with small amounts and diversify your portfolio. Many platforms offer demo accounts, allowing you to test your strategies without financial risk.

Keep learning

The crypto market moves fast. New coins, technology updates, and global events can all affect prices. Stay up to date by:

Subscribing to crypto newsletters

Following industry blogs

Joining trading forums and communities

Learning to trade is an ongoing process — the more informed you are, the better your chances of success.

About the author

Hi, I'm Philipp. 👋

Founder coinbird.com

With over 15 years of experience in the IT sector, I love building easy-to-use digital products that actually help people. In 2017, I fell down the Bitcoin rabbit hole and gradually realized that the crypto world lacked simple, user-friendly tools for everyday people. That’s why I created coinbird.com – to make crypto easier to understand, more accessible, and transparent.

LinkedIn