How Can You Analyze and Evaluate Cryptocurrencies?

The valuation of traditional financial assets like stocks is often based on countless metrics related to productivity and profitability. With cryptocurrencies, however, the focus usually isn’t on a company but rather on a network—its protocol, technology, and the so-called “tokenomics” (token economics).

Table of contents

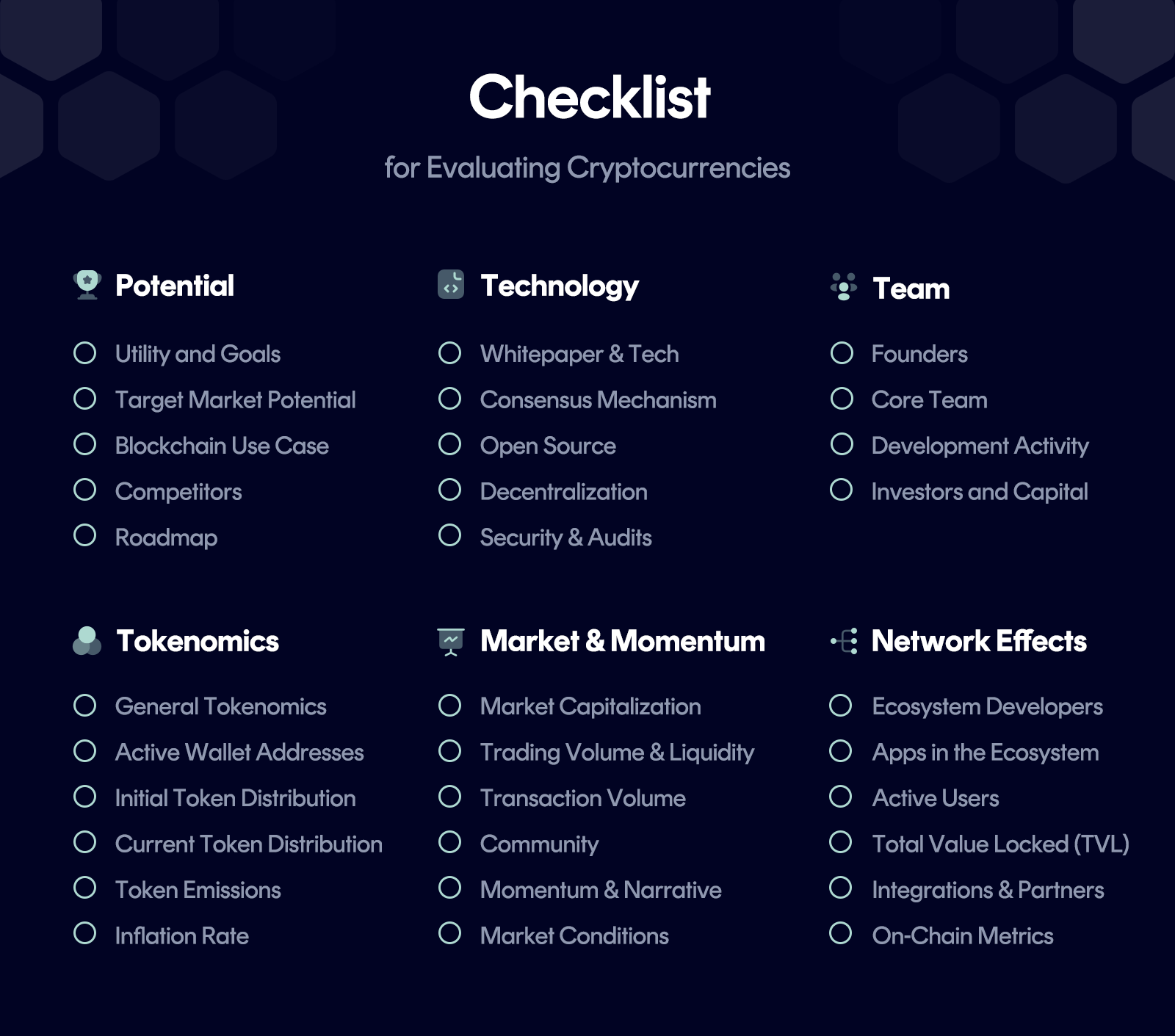

Evaluating Cryptocurrencies in 6 Steps

These are the essential steps we use in our framework for evaluating cryptocurrencies.

Step 1: Potential

Step 2: Technology

Step 3: Team

Step 4: Tokenomics

Step 5: Market & Momentum

Step 6: Network Effects

Step 1: Evaluating Potential

Utility and Goals

It’s crucial to get an overview in order to analyze and evaluate the specific utility and goals of a crypto project. What problem does the project—or its cryptocurrency—aim to solve? Does it significantly improve an existing solution? The best sources for this research are the project’s official website, its whitepaper, or dedicated Reddit forums.

Target Market Potential

Once you’ve identified the specific problem being addressed or the improvement proposed, ask yourself how important and significant the problem is, and how large the potential market could be. Is the project solving an issue faced by many individuals or businesses, and how valuable is this solution?

Blockchain Use Case

A blockchain isn’t always necessary and comes with notable disadvantages alongside its benefits. Blockchain systems, including their management and validation processes, are often slower and more complex than traditional databases. Is there a strong reason why blockchain is required to solve this problem or deliver improvements? Could the project’s idea work without a blockchain or decentralized database? A distributed ledger typically makes sense only when there’s a trust issue between different parties. There are several decision-making frameworks you can use for this analysis as well.

Competitors

A traditional competitor analysis helps you understand the market landscape. Are there already other cryptocurrencies or projects pursuing a similar goal? If so, dig deeper to understand these projects and examine their similarities and differences. Are they direct competitors, or could they be complementary? Websites like CoinMarketCap offer overviews of cryptocurrencies categorized by industry and sector.

Roadmap

Many crypto projects and cryptocurrencies publish a roadmap on their website, outlining their current stage of development and what features and innovations are planned for the future. Beyond the content of this roadmap, it’s also worth checking whether the team has met past milestones within their projected timelines.

Step 2: Evaluating the Technology

Whitepaper and Technology

The whitepaper of a cryptocurrency is the best starting point to understand the technical details and potential innovations of a project. Whitepapers tend to be highly technical, often filled with specialized terminology and mathematical formulas. If that’s overwhelming, you can usually find simpler explanations on the project’s official website or in various guide blogs. Evaluating the technology can be challenging for non-experts.

Consensus Mechanism

The consensus mechanism—often also called the consensus algorithm—is the heart of a blockchain. It defines how transactions are synchronized, validated, executed, and how new blocks are created. There are many different implementations, with the most well-known being Proof of Work (e.g. Bitcoin) and Proof of Stake (e.g. Ethereum). Each model has specific advantages and disadvantages, and it’s worth having at least a basic understanding. The whitepaper on a project’s website is the best source for detailed information about the blockchain’s chosen consensus mechanism.

Open Source

A crucial criterion for evaluating cryptocurrencies—and a fundamental pillar of decentralized protocols—is open source. A project and its code components (e.g. smart contracts) should always be transparently accessible. Ideally, the entire community can participate in the project, proposing improvements or submitting bug fixes. Open-source development is usually managed through platforms like GitHub (Bitcoin is a prime example).

Decentralization

One of the core principles of blockchain is decentralization, designed to prevent manipulation and eliminate a single point of failure. The higher the number of miners or validators operating a network—and the more globally distributed and independent they are—the more decentralized the network becomes. Decentralization is often a hot topic in the crypto space. Bitcoin purists, for instance, consider Bitcoin the only truly decentralized cryptocurrency. While Bitcoin is certainly the most decentralized and secure network by far, decentralization should be seen as a spectrum. For some use cases (e.g. money/Bitcoin), maximum decentralization is essential, while for others, a slightly less decentralized solution might suffice. As a rule of thumb: the more attractive a system is for potential threats (monetary, social, political), the more crucial decentralization becomes.

Security and Audits

Blockchain networks often hold significant amounts of value, making them prime targets for hackers constantly looking for vulnerabilities in the code. Open-source development and bug bounties (rewards for discovering security flaws) help with prevention. However, especially during a project’s launch and throughout its lifecycle, it’s essential to conduct regular security audits by external firms (e.g. CertiK, Hacken). Completed audits are usually showcased or communicated on project websites. If a project does not undergo regular audits, this could be an immediate red flag regarding its security.

Step 3: Evaluating the Team

Founders and Leadership

For a pragmatic analysis of a team’s quality, start by researching the founders and key leadership. A quick background check on LinkedIn can help you assess their skills, experience, and track record. The less information available about the team, the more cautious you should be. A fully anonymous team is generally a red flag.

Core Team

The technical and professional competence of the broader team plays a major role in the quality and speed of execution. It’s worth checking the profiles of team members on LinkedIn as well. Most crypto projects feature a section on their website showcasing their team.

Development Activity

To get a rough sense of a project’s development momentum, check its GitHub profile. Here, you can examine the codebase and view various statistics—for example, how many contributors are working on the project and how frequently new updates are being made.

Investors and Capital

It can also be insightful to analyze the investors backing the project. Many crypto projects raise significant sums from VCs (Venture Capital) or business angels, often in exchange for discounted tokens or coins. Well-known investors and prominent names contribute significantly to a project’s credibility. Substantial funding rounds provide a startup with both the time and financial resources needed to realize its vision. Details on funding amounts and participants can often be found on Crunchbase. You can also explore investor overviews on platforms like Messari.io (e.g. in the case of Solana).

Step 4: Evaluating Tokenomics

General Tokenomics

The term “Tokenomics” is a blend of “Token” and “Economics” and refers to the economic structure behind a crypto project. Cryptocurrencies—both coins and tokens—are central to the internal incentive models of a blockchain. Evaluating a cryptocurrency’s tokenomics typically includes the following areas:

Token Allocation (e.g. team, investors, public, etc.)

Total Supply, Emission, and Token Burning

Token Demand and Utility

Token Distribution Across Addresses

Mining and Staking Models

Active Wallet Addresses

A useful indicator for analyzing a cryptocurrency is the trend in the number of active wallet addresses. This metric can reveal whether a network is continually attracting new users or whether usage is stagnating or declining. Comparing this metric with other projects can help isolate broader market trends. Data on active addresses is available via platforms like Messari, CryptoQuant (e.g. for Bitcoin), or CertiK (e.g. for Polygon).

Initial Token Distribution

New crypto projects often allocate tokens for different purposes. A portion typically stays with the project to fund development and marketing. Another share might go to early investors, and so on. How tokens are distributed at launch is an important factor when evaluating a project’s tokenomics. Generally, a lower allocation to the community (via public sales, airdrops, etc.) is viewed negatively. Messari provides insights into token distribution for various projects (e.g. Solana).

Current Token Distribution

The more evenly distributed a cryptocurrency is across network participants, the better. Ideally, there should be a wide range of addresses holding small to medium amounts of tokens. If only a few wallets control a large portion of the supply, it can weaken the token economy. Data on token distribution across addresses (e.g. for Ethereum) is also available via Messari.

Token Emission

Project websites or analytical tools can help determine how new token emissions are managed. Emissions should not be excessively high, as this leads to inflation. Many projects implement burn mechanisms that automatically reduce circulating supply to counteract inflationary effects.

Inflation Rate

Generally, a lower inflation rate is preferable. The annual inflation rate of a cryptocurrency is calculated by dividing the projected increase in liquid supply over the next 12 months by the current liquid supply. You can find further details and comparisons of inflation rates among popular cryptocurrencies in our blog post about crypto inflation.

Step 5: Evaluating Market & Momentum

Market Capitalization

Market capitalization is one of the most widely used metrics for assessing cryptocurrencies. Similar to stocks, it represents the total valuation of a project. It’s calculated by multiplying the circulating supply of coins or tokens by the current price. However, market cap alone isn’t necessarily meaningful (due to potential inaccuracies in data) and should never be the sole basis for decisions. Still, it provides a quick and simple snapshot of a cryptocurrency’s size and popularity.

Trading Volume & Liquidity

Trading volume indicates how frequently a cryptocurrency has been traded on crypto exchanges over the past 24 hours. It reflects the combined trading activity across major exchanges. This figure is an important metric for gauging liquidity and trading intensity. Cryptocurrencies with low liquidity can be particularly susceptible to price manipulation from relatively small capital movements. You can find trading volume data on platforms like Messari or CoinMarketCap.

Transaction Volume

Transaction volume helps analyze and assess the network activity of a cryptocurrency. This metric measures the total dollar value of transactions happening directly on the blockchain, unlike trading volume, which reflects exchange activity. Data on transaction volumes for various cryptocurrencies can be found on Messari or Coin Metrics.

Community

The size and engagement of a community are good indicators of a project’s popularity and the strength of its network effects. For blockchain projects, an enthusiastic and supportive community is a crucial success factor. To gauge a community’s size and activity, look at the project’s presence on platforms such as Twitter, Reddit, Discord, and Telegram.

Momentum & Narrative

During bullish market phases, certain leading themes—known as narratives—often emerge. Identifying and capitalizing on these narratives can be important for short- to medium-term investment strategies. It’s equally crucial to leverage momentum. Hype and speculation are frequent elements in the crypto market, and savvy investors may use these dynamics for short-term opportunities.

Market Conditions

Finally, it’s essential to evaluate the broader market environment, especially for short-term trading. For long-term investors, quieter market phases often present opportunities to identify and accumulate high-quality crypto projects. Conversely, dynamic bull markets may be more suitable for speculative strategies and leveraged trading.

Step 6: Evaluating Network Effects

Developers in the ecosystem

The number of (external) developers building projects within a blockchain ecosystem is one of the most important foundations for strong network effects and should always be part of any analysis and evaluation. New projects and use cases emerge from this developer activity, which in turn attract new users.

Apps in the ecosystem

Developers create a second important pillar: the number of applications in a cryptocurrency’s ecosystem. It’s not just the quantity of apps that matters, but also their quality and user adoption. A rough overview can be found, for example, on platforms like DappRadar or DefiLlama.

Active users

For a rough assessment of user numbers and their development, DappRadar and DefiLlama are useful sources. For fundamental analysis, looking at trends in active wallet addresses (e.g. for Uniswap) can also provide insights into a project’s user growth.

Total Value Locked (TVL)

Total Value Locked (TVL) refers to the total capital locked up in a DeFi (Decentralized Finance) protocol. It represents the total value managed by the blockchain ecosystem—for example through staking, lending, liquidity pools or similar mechanisms. A protocol’s TVL can provide insights into its size, usage, and the level of trust it has earned, making it a very important indicator for fundamental analysis and the valuation of DeFi projects.

Integration and partners

Integrations of a protocol into other applications, for example from the traditional financial world, are also crucial for strengthening network effects. Strong partnerships with major brands and well-known names can help a crypto project gain more visibility and credibility.

On-chain metrics

One of the key advantages of blockchains is their uncompromising transparency, which can be a major asset for fundamental analysis and valuation of cryptocurrencies. Especially for short- to medium-term forecasts, so-called on-chain data—publicly visible blockchain data—can be very useful. This leads to interesting metrics like Net Unrealized Profit/Loss (NUPL). More valuable blockchain data can be found on platforms like Glassnode or CryptoQuant.

Tools for Analyzing Cryptocurrencies

CoinMarketCap: The most popular go-to source for basic crypto market information

Messari: Data and research tailored for professional investors

Glassnode: Blockchain metrics, market data, and statistics

DefiLlama: Statistics on Decentralized Finance (DeFi) and blockchain ecosystems

Token Terminal: Fundamental data for analyzing cryptocurrencies

Nansen: Real-time blockchain data on crypto transactions, NFTs, and more

Dune Analytics: Create and share custom crypto dashboards

The Block: Market and on-chain metrics, plus crypto news

CertiK: Data on security, audits, and other key metrics

LunarCrush: Social media analytics for cryptocurrencies and NFTs

DappRadar: Data on decentralized applications (DApps)

Staking Rewards: Data on staking, staking providers, and DeFi platforms

CoinMarketCal: Dates and insights on airdrops, ICOs, token unlocks, and more

Frequently Asked Questions About Evaluating Cryptocurrencies

How can you analyze cryptocurrencies?

How can you evaluate cryptocurrencies?

What indicators exist for cryptocurrencies?

What is tokenomics?

Why do cryptocurrencies have value?

Which cryptocurrencies have potential and a future?

About the author

Hi, I'm Philipp. 👋

Founder coinbird.com

With over 15 years of experience in the IT sector, I love building easy-to-use digital products that actually help people. In 2017, I fell down the Bitcoin rabbit hole and gradually realized that the crypto world lacked simple, user-friendly tools for everyday people. That’s why I created coinbird.com – to make crypto easier to understand, more accessible, and transparent.

LinkedIn