Definition of NFT – Non-Fungible Token

The abbreviation “NFT” stands for “Non-Fungible Token.” NFTs are unique digital tokens that, thanks to modern blockchain technology, can be firmly and publicly linked to a specific owner. They are tamper-proof and cannot be duplicated at will. Because of the blockchain and its globally distributed copies, no one can simply pull the plug, reverse transactions, or take NFTs away from an owner—not a company, government agency, or state.

Table of contents

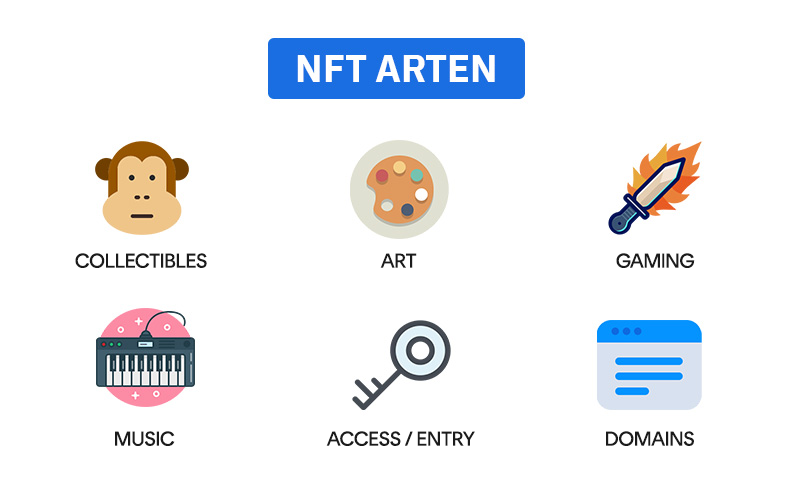

The use cases for Non-Fungible Tokens are diverse: digital trading cards, digital artworks, event tickets, virtual real estate, audio files, video clips, tweets, gaming content — many things can be tokenized and thus created as NFTs. You’ll find more information about different types of NFTs in the “Examples” section. In the following comparison, we’d like to highlight the advantages of NFTs:

| Internet with NFTs | Internet Status Quo |

|---|---|

| NFTs are digital and unique. | A copy of a file like an .mp3 or .jpg is the same as the original. |

| Every NFT has an owner who can be clearly viewed and verified through the blockchain. | Ownership rights are stored on central servers, whose owners you have to trust. |

| NFTs are compatible with anything built on Ethereum. For example, an NFT ticket for an event could be exchanged for a piece of artwork. | Every company with digital items builds its own infrastructure and marketplace. The items can’t be traded across platforms. |

| Content creators can sell and trade their work anywhere on a global marketplace. | Content creators have to rely on the infrastructure and distribution of the platform they use, which often comes with geographic restrictions. |

| Creators can retain rights to their work and earn directly from future resales. | Platforms like streaming services often keep a large share of the sales. |

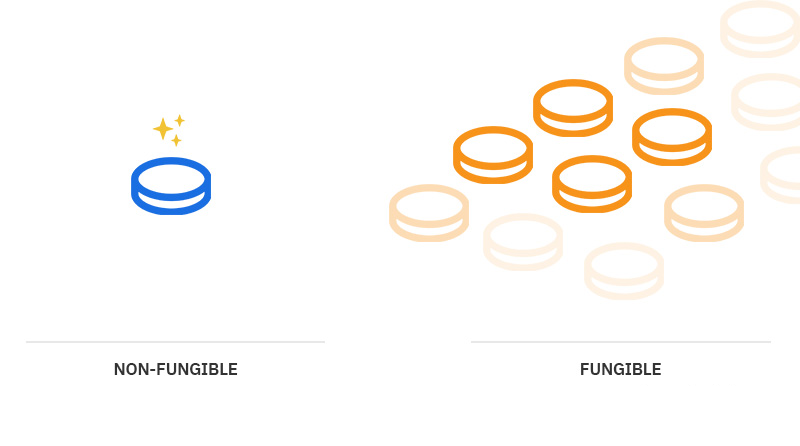

What’s the difference between non-fungible and fungible?

To understand what a Non-Fungible Token is and what makes NFTs so special, it’s important to know the difference between fungible and non-fungible. When something is fungible, it’s interchangeable. Good everyday examples include cash and securities. A ten-euro bill always functions the same way and is worth exactly as much as any other ten-euro bill. If you buy a share of Apple, you get precisely the same stake in the company as any other shareholder.

Non-fungible things, on the other hand, are not easily interchangeable—even if they might look similar at first glance. Classic examples are works of art. If you replaced the Mona Lisa in the Louvre in Paris with another painting by Leonardo da Vinci, it would quickly cause quite a stir. Another everyday example is movie tickets. A cinema issues hundreds of tickets every day that all look identical at first glance. But those tickets are valid for completely different films, showtimes, and seats—so they’re not interchangeable and therefore non-fungible.

How does an NFT work?

In the crypto world, many things are fungible. Cryptocurrencies like Bitcoin and Ethereum (Ether) are easily interchangeable—just like cash. If you send one Bitcoin and receive a different Bitcoin a week later, you wouldn’t notice any difference. A Bitcoin is a Bitcoin. The same applies to many tokens, such as ERC-20 tokens on the Ethereum platform. One hundred BAT tokens can easily be swapped for another hundred BAT tokens, and even exchanging 100,000 Shiba Inu tokens for another 100,000 would go unnoticed by the owner.

With Non-Fungible Tokens (NFTs), it’s different. The ERC-721 standard, introduced on the Ethereum platform in January 2018, laid the foundation for this. Each ERC-721 token can be individually designed, may have different properties than other tokens from the same smart contract, and is therefore unique. This allows artists and developers to create entire series of artworks, avatars, digital trading cards, or other NFT implementations, where each token is distinct—not only visually but also technically. All the advantages of blockchain—decentralization, transparency, and tamper resistance—remain intact.

ERC-721 tokens, like ERC-20 tokens and cryptocurrencies, can change ownership, which is why NFTs can be traded on exchanges. All you need is an NFT marketplace like OpenSea.io and a compatible wallet such as MetaMask, plus some Ether to cover transaction fees. From there, you can buy and sell NFTs.

Besides Ethereum, there are now numerous other blockchains and crypto platforms that support NFTs, including Solana, Avalanche, and others.

Examples: What types of NFTs exist?

The technology behind NFTs is extremely versatile. There are virtually no limits to what’s possible—almost anything, from trading cards and tweets to virtual land, can be tokenized and turned into a unique, tamper-proof NFT. While NFTs have become especially popular for collectibles and digital artworks, there are also emerging projects that go far beyond these uses.

Collectibles: NFT art and collectibles

Well-known and popular NFTs in the collectibles space:

An early and popular use case for NFTs is collectibles, meaning digital collectibles and art. These can include avatars, graphics, and images, but even football and basketball trading cards have already made their way onto the blockchain, where they can be collected and traded as NFTs to your heart’s content. Technically, these digital collectibles are usually image files in formats like JPG or GIF, which you could theoretically just save and duplicate. “Right-click, save as…” — and you’re done. Or are you?

By linking a collectible to a token on the blockchain, the collectibles become distinctive and unique NFTs, making them easy to trade and clearly assign ownership at any time. A quick look at the blockchain is enough to see who truly owns the collectible and who merely has a copy. An NFT essentially serves as a kind of certificate of authenticity.

As a bonus, owners of collectibles typically receive usage rights, allowing them to proudly display their digital artwork as an avatar or profile picture on social media platforms like Twitter. However, the copyright often remains with the original artist and is not transferred to the buyer.

Some of the best-known NFT projects in the collectibles space include the CryptoPunks, launched in June 2017 by two Canadian developers on the Ethereum network, which played a significant role in fueling the NFT hype in the spring of 2021. The collection consists of 10,000 pixelated punks, randomly generated by an algorithm to ensure that each punk has unique traits and a one-of-a-kind appearance. Some punks wear sunglasses, others sport earrings or smoke a cigarette—no CryptoPunk is identical to another character.

The CryptoPunks have become prime examples in the NFT space, not least because of their high prices. Individual CryptoPunks have frequently changed hands for Ether worth several hundreds of thousands of euros and have even been traded for sums in the millions. In spring 2017, a set of nine CryptoPunks sold for 17 million US dollars at the prestigious London auction house Christie’s.

Several institutional investors and companies couldn’t resist the hype surrounding these pixelated punks. In the summer of 2021, the credit card company VISA purchased CryptoPunk number 7610 to expand its in-house collection of historic artifacts, which now includes, alongside an early paper credit card and the iconic zip-zap machine, an NFT.

Another example of the success of collectibles as NFTs is the Bored Ape Yacht Club (BAYC). Much like the CryptoPunks, the collection consists of 10,000 unique collectibles—stylized cartoon apes. Each Bored Ape NFT differs based on seven traits: background color, clothing style, earring, eyes, fur, hat, and mouth. Thanks to these random combinations, every cartoon ape has a unique appearance.

Some apes stand out not only visually due to special and rare attributes but also fetch significantly higher prices than more common Bored Apes. The cartoon apes were initially sold in the spring for 0.08 Ether each—equivalent to around 250 US dollars at the time—and sold out within the first day. The subsequent price development was no less impressive than that of the CryptoPunks.

In September 2021, a particularly rare ape was purchased for 600 Ether, equivalent to about 2.25 million US dollars. In the same month, a bundle of 107 BAYC NFTs sold for 24.4 million US dollars during an online auction at the renowned New York auction house Sotheby’s.

It’s not just images, avatars, and artworks that change hands as NFTs, but also other collectibles and historical content. The first tweet by Twitter founder and co-founder Jack Dorsey from March 21, 2006, reading “Just setting up my twttr,” sold as an NFT for 2.9 million US dollars in an online auction.

NFT Games

Well-known and popular NFT games:

Axie Infinity

SoRare

Star Atlas

The Sandbox

Decentraland

Illuvium

Another application of NFTs that goes beyond pure collecting is NFT games. One of the pioneers in this field was the Canadian company Axiom Zen, which launched CryptoKitties at the end of 2017. The unique aspect of CryptoKitties is the gaming component, which adds even more incentive for people to dive into the NFT world.

Owners of CryptoKitties don’t just collect their digital cats—they can also breed them. By pairing them strategically, they can create new cats with rare and special traits. These digital pets pass their attributes on to the next generation, making cats with unique features especially sought-after and valuable.

CryptoKitties quickly became a success. In December 2017, digital cats were traded for prices ranging from $3.50 to $100,000. In spring 2018, one CryptoKitty sold at auction for 140,000 US dollars. At one point, the NFT series accounted for more than ten percent of all Ethereum transactions and, in December 2017—just shortly after its launch—achieved trading volumes in the tens of millions.

This made CryptoKitties a financial success for the company behind it, which earns a 3.75 percent commission on every transaction.

Another NFT game is Sorare. Sorare brings football trading cards—familiar to almost everyone from childhood—onto the blockchain, transforming them into a fully-fledged global football manager and fantasy football game. Every player card on the Sorare platform is an NFT, implemented as a unique ERC-721 token on the Ethereum network, where it can be traded and exchanged.

What makes Sorare special is that the NFT game holds numerous official licenses thanks to partnerships with many clubs and leagues—including the German Bundesliga.

Football fans can play the NFT game featuring their favorite players and benefit from the real-life performances of those players on the pitch. Positive actions like goals and assists, as well as negative actions like red cards, earn players in real matches scores ranging from 0 to 100 points. These points are then reflected on their NFT counterparts and determine the success or failure of a user’s Sorare team, which can be continually improved through strategic trading and transactions.

Other Types of NFTs: Domains, Metaverse, and More

Collectibles and NFT games have been popular and widespread use cases since NFTs first emerged. However, there are many other applications that have already been realized or at least envisioned.

One creative example of NFT usage comes from Unstoppable Domains. This project offers NFT domains—tokenized web addresses. Interested users can purchase a custom domain with endings like .crypto, .bitcoin, .nft, or .x, which is then stored as an NFT in their personal wallet. The advantage is that ownership rights are fully transparent and no authority can take the domain away from the owner recorded on the globally distributed blockchain. A single payment secures ownership of the new domain—complete with a digital certificate of authenticity in NFT form. Another exciting project in the field of blockchain domains is ENS – Ethereum Name Service.

Further potential applications arise in connection with the Metaverse, a kind of virtual space with extended physical reality, being developed by companies like Meta Platforms (formerly Facebook Inc.) as well as other established tech firms. NFTs play a crucial role in the Metaverse because they can reliably and securely represent ownership rights in digital life. Clothing/fashion, accessories, vehicles, and virtual real estate—almost everything in the Metaverse can be managed using blockchain technology and NFTs.

NFT Marketplaces

On NFT marketplaces, NFTs can be bought and sold. Most NFTs are based on the Ethereum blockchain and are therefore traded using the cryptocurrency Ether (ETH). To get started, all you need is a MetaMask wallet. If you don’t yet own any Ether, you can purchase it on a crypto exchange.

The most well-known NFT marketplaces compared:

| Marketplace | Founded | Fees | Blockchains | Formats | Maximum file size |

|---|---|---|---|---|---|

| OpenSea | 2017 | bis 2,5% | Ethereum, Polygon, Klatyn | JPEG, PNG, GIF, GLB/GLTF, MP3, MP4, WAV, WEBM | 100 MB |

| Rarible | 2020 | 2,5% | Ethereum, Flow, Tezos | JPEG, PNG, GIF, WEBP, MP3, MP4, WMV | 30 MB |

| SuperRare | 2018 | 3% | Ethereum | JPEG, PNG, GIF, MP4 | 50 MB |

| MagicEden | 2021 | 2% | Solana | JPEG, PNG, GIF, MP4, SVG, MP3, MP4, WAV, MOV | N/A |

| Foundation | 2020 | 15% | Ethereum | JPEG, PNG, GIF, MP4 | 50 MB |

There’s a growing number of marketplaces for all buyers, sellers, and collectors of Non-Fungible Tokens. By far the most important and largest NFT marketplace at the moment is OpenSea.

Open Sea

OpenSea was founded on December 20, 2017, by Devin Finzer and Alex Atallah and has evolved over time into an all-in-one solution for NFTs. On OpenSea.io, users can buy NFTs and invest in collectibles of all kinds—either through direct purchases or by placing bids in auctions. In their personal profiles, users can also view a gallery of all the NFTs held in their wallets.

However, OpenSea isn’t just a hub for buyers; it also allows users to create their own NFTs and sell entire NFT collections. This has attracted well-known artists like Banksy and Takashi Murakami, who have sold artworks via OpenSea. The platform primarily uses the ERC-721 standard on the Ethereum network but also supports Polygon and Klaytn. OpenSea works conveniently in the browser by connecting to a compatible wallet like MetaMask. There are also official apps for Android and iOS, making it easy to trade NFTs on the go via smartphone or tablet.

Rarible

Rarible is another NFT platform, founded in 2020 by Alex Salnikov and Alexei Falin. Like OpenSea, Rarible is a marketplace that connects buyers and sellers. Buyers can purchase all kinds of collectibles and other NFTs, while sellers have the opportunity to monetize their art or other creative NFTs on Rarible.

Technically, Rarible works much like OpenSea, primarily operating on the Ethereum platform, but it also supports alternative blockchains like Flow and Tezos. Users simply need to connect a compatible wallet like MetaMask to Rarible, after which they can invest in NFTs or offer their own collectibles for sale. Compared to OpenSea, Rarible places a greater emphasis on community and even operates its own governance token, RARI, which rewards users for active participation and gives them a say in the platform’s development.

Non-Fungible Tokens (NFTs) are still a relatively new concept, and platforms like OpenSea.io and Rarible.com were the first to successfully establish themselves in this niche. Both specialized platforms have generated billions in revenue, which hasn’t gone unnoticed by more established players. The publicly traded exchange Coinbase soon announced its own solution for buying, selling, showcasing, and discovering NFTs.

For users, this is good news. Competition drives innovation, and increasing rivalry will likely lead to lower fees.

How can you make money with NFTs?

There are two main ways to make money with NFTs. The most obvious option is speculation—that is, buying NFTs at a low price and selling them for a profit. Those who invested early in a rare CryptoPunk or a special ape from the Bored Ape Yacht Club were able to earn millions in profits with a bit of luck. But even on a smaller scale, investors have repeatedly had opportunities to profit from significant price increases in collectibles.

What should you consider before buying NFTs?

The following factors should be analyzed before buying an NFT (in this case, collectibles) and can help you make a better investment decision. It’s always important to remember that a large portion of NFT projects will likely have little or no long-term value.

Hype: How much buzz is there around the NFT project?

Roadmap: What features and benefits does the team plan for NFT holders?

Brands: Who is promoting the project? (Influencers, community, awareness)

Team: Who are the people behind the NFT project?

Numbers: Average value of the collection, trading volume, floor prices

Community: How large is the community on Discord and Twitter?

Another way to make money with NFTs is available to artists and creatives: creating and selling your own NFTs. Anyone can generate their own Non-Fungible Tokens on NFT platforms like OpenSea or Rarible. The type of work doesn’t really matter. Images, avatars, and other art in JPG, PNG, or GIF formats are particularly popular, but an NFT can also be an MP4 video or an MP3 audio file. There are virtually no limits to creativity.

Unlike selling traditional art, DVDs, or CDs, distributing work as an NFT has a significant advantage: recurring revenue. NFT creators can not only set a fixed sales price or launch an auction but also define royalties, allowing them to earn a percentage from every future resale. The technical implementation as a unique, one-of-a-kind Non-Fungible Token on the blockchain makes this possible.

How can I create NFTs?

To create your own NFTs and earn money with art, videos, music, or other tokenized content, you don’t need any special programming skills. Users simply need to connect a compatible wallet, such as MetaMask, to an NFT platform like OpenSea or Rarible.

These platforms then guide users—who should be comfortable following instructions in English—step by step through the creation process. Upload a file, choose a name, add a description—and you’re done.

After that, users can set additional details and choose which blockchain the Non-Fungible Tokens should be created on. With a click on “Create,” the NFTs are generated on the blockchain—a process known as minting. Once the minting process is complete on the blockchain, the NFTs are tradable and ready for a new owner.

Fees for Creating NFTs

Platforms like OpenSea.io and Rarible charge fees of around 2.5% for their services. Additionally, there are network fees within the blockchain itself, such as gas fees when using Ethereum. Some NFT platforms allow sellers to set it so that the buyer covers these fees. This helps reduce costs for artists and creators, making it a bit more affordable and easier to enter the world of NFTs.

The Future and Potential of NFTs

NFT technology is still in its early stages. Non-Fungible Tokens have certainly gained recognition in the crypto scene thanks to the success of collectibles like the CryptoPunks and the Bored Ape Yacht Club, attracting prominent buyers such as VISA, Adidas, Sotheby’s, and many others. However, NFTs have yet to fully break through into the mainstream. Artists and crypto enthusiasts who want to experiment with NFTs often struggle to understand what a “Non-Fungible Token” actually is, and jumping in isn’t always easy. A major hurdle is the high fees associated with using the Ethereum network.

The gas fees that must be paid for each transaction on the Ethereum blockchain often amount to several hundred dollars or euros, due to network congestion and the need for fast confirmation times. This discourages newcomers—both on the buyer’s side and among NFT creators. Short-term measures like EIP-1559 to reduce fees have often had little impact, and the transition to Ethereum 2.0, which promises more sustainable improvements, is still in the future.

There is hope for lower fees through alternative smart contract platforms that support NFTs, such as Solana or Tezos, which can operate with significantly lower transaction costs and thus make it much easier for users to get started. However, these low fees often come at the expense of decentralization within the network.

Legal questions surrounding NFTs also remain largely unresolved and can be discouraging. How are NFTs treated for tax purposes? What impact does tokenization have on copyright? How do data privacy concerns come into play? The lack of legal precedents and the many different national regulations for a technology as young as NFTs contribute to uncertainty among investors and NFT artists alike.

Environmental sustainability is another concern. A large share of NFT projects currently operate on the Ethereum blockchain, which still relies on the Proof-of-Work algorithm—meaning vast computational power and significant electricity consumption. As a result, every transaction—including both the minting of NFTs and trading them—consumes considerable resources and generates harmful emissions. At a time when investors are increasingly paying attention to environmentally and socially responsible criteria (ESG or SRI), this is an important issue.

Finally, the practical applications for NFTs are still relatively limited. For now, it’s mainly collectibles that are driving NFT adoption, as they tap into people’s passion for collecting and, of course, invite speculation. For emerging artists eager to try something new, or for athletes looking to earn additional income, collectibles on the blockchain can already provide a valuable revenue stream. However, the big “killer app” for NFTs has yet to emerge, which is why many are looking to the Metaverse, where major tech companies are investing heavily.

Perhaps in the future, it will be completely normal to receive a digital NFT version of your new Adidas sneakers to show off in the Metaverse. Or maybe, after NFTs achieve widespread adoption, it will be standard for concert tickets or airline boarding passes to exist as unique, tamper-proof tokens on the blockchain, securely linked to their rightful owner. The potential applications for Non-Fungible Tokens are certainly diverse, and there are very few things that can’t be tokenized. That’s what makes their potential so enormous.

About the author

Hi, I'm Philipp. 👋

Founder coinbird.com

With over 15 years of experience in the IT sector, I love building easy-to-use digital products that actually help people. In 2017, I fell down the Bitcoin rabbit hole and gradually realized that the crypto world lacked simple, user-friendly tools for everyday people. That’s why I created coinbird.com – to make crypto easier to understand, more accessible, and transparent.

LinkedIn