The Idea and History of Blockchain

Blockchain is a technological development with the potential to fundamentally change the way we communicate and interact globally. Because of its unique properties, it’s said to have the power to transform entire industries—or even make some obsolete altogether.

Table of contents

This disruptive potential lies in how blockchain works. The technology is designed to enable the borderless exchange of information, value, and assets of any kind—without relying on intermediary institutions such as corporations, banks, or governments. Blockchain essentially replaces the role of these intermediaries in reducing uncertainty and creating trust.

The idea for blockchain was first published in 2008, although the underlying technological concepts go back further. The original vision was to create a decentralized currency that would be free from the influence of banks and governments. This currency was called Bitcoin, and to this day, it remains the most prominent example of blockchain technology. To date, nobody knows who actually authored the publication (the famous white paper) about Bitcoin, as it was released under the pseudonym Satoshi Nakamoto—which could refer to either a single individual or a group.

Since then, blockchain has become a phenomenon capturing the attention of private individuals, governments, businesses, and public institutions alike. Its technological capabilities, disruptive ambitions, and financial investment opportunities spark considerable interest. The latter, in particular, have created a gold rush atmosphere and led to multi-billion-dollar investments, often fueling speculation about a potential bubble. Yet these side effects sometimes drown out the real potential of this innovative breakthrough. Because of the global fascination, the rise of blockchain is frequently compared to the emergence of the internet in the early 1990s. It’s therefore well worth taking a closer look at the technology and its unique characteristics.

In summary, blockchain is a decentralized peer-to-peer network that uses cryptography to create a secure, transparent, and optionally anonymous system. As a result, it minimizes uncertainty and transaction costs, removes the need to place trust in individual participants, and prevents the exclusion of people from the system.

To make this definition clearer, let’s explore the individual aspects in more detail below:

Characteristics of a Blockchain

Decentralization

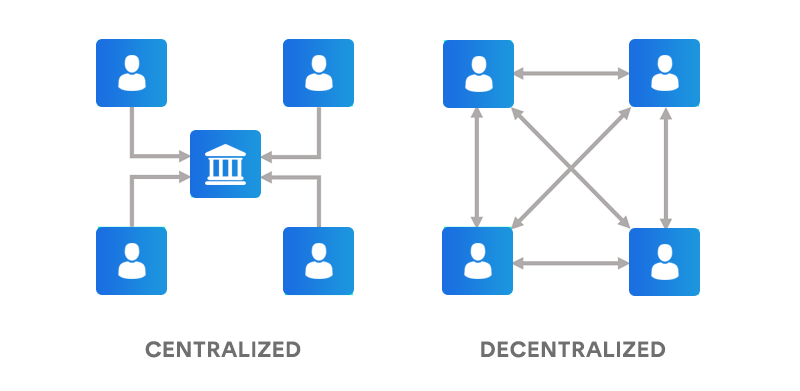

One of the most important characteristics of blockchain is its departure from centralized structures. This refers to the distribution of power within the system, which is evenly spread out. The goal is to prevent the emergence of central authorities, so users no longer have to place trust in them or be vulnerable to potential abuse of power. Institutions that currently hold such central positions include banks, governments, or corporations operating in monopolistic or oligopolistic sectors.

Irreversibility

All information ever recorded on a blockchain is stored irreversibly and cannot be changed. This principle is also where the term blockchain—literally “chain of blocks”—comes from. A block represents a collection of the system’s latest information. These blocks are linked together sequentially, forming a chain that constantly grows as new blocks are added. Once a new block is connected to the preceding one, it and its stored data are permanently recorded and immutable.

Transparency

Blockchain is transparent in that all interactions and activities within the system are publicly visible and irreversibly documented. It’s possible to view every piece of information, but not alter it. No data is ever deleted; instead, information about changes is added on top of existing records. This means every change and access within the system can be traced back to the very beginning. Because control is distributed in a decentralized manner, there can be no hidden or opaque processes.

Anonymity

One of the most frequently discussed characteristics of blockchain is the anonymity of its participants. While all interactions and activities are transparently visible, participants themselves are represented only by cryptographically encrypted strings of numbers. Depending on the type of blockchain, it can be very difficult—or sometimes nearly impossible—to determine the real identity behind a participant.

The advantages resulting from these characteristics are diverse and far-reaching.

Advantages of a Blockchain

Security

The combination of decentralization, irreversibility, and transparency theoretically creates a perfect and fraud-proof system. A blockchain always stores and updates the entire history of information that has ever occurred within the system. The unique aspect lies in the principle of decentralization, which means this history isn’t stored in one central place but is instead distributed separately across many participants. To manipulate this system, one would theoretically have to alter every single blockchain copy held by countless participants at the same time—something considered practically impossible and not worthwhile. The more participants a blockchain has, the more secure it generally becomes.

Trust

The security of the system eliminates the need to place trust in other participants (intermediaries). All interactions become free from uncertainty or fear of fraud. What used to be the job of intermediaries like governments, banks, or corporations is now handled by blockchain technology itself. Because of this, blockchain is sometimes referred to as a “Trust Protocol.”

Low Transaction Costs

Using intermediary institutions typically results in transaction costs. Fees are charged for services that create trust and security between parties, or costs arise due to processing and administrative work. Blockchain technology reduces the need for such services, enabling direct peer-to-peer (P2P) interactions without transaction fees in the form of commissions or service charges. Whether buying a used bicycle, sending money, or booking a flight, these transactions can take place without today’s typical fees. As a result, transaction costs for participants in a blockchain network can be minimized.

Access

The barriers to participating in a blockchain system are relatively low. All you need is a device with an internet connection—a condition now met by more than four billion people worldwide. This is significantly more than those who currently meet the requirements to access financial services or insurance products from centralized institutions. Blockchain opens the door for a large portion of the global population—previously excluded—to participate in global exchange and trade.

How Does a Blockchain Work?

A blockchain is based on a simple peer-to-peer (P2P) database. Within this system, participants interact directly with one another. There’s no central authority managing regulation, oversight, control, or account administration.

This feature might seem trivial at first but is actually incredibly important. Many modern applications appear to enable direct interaction but, in reality, do not. Whether it’s a messaging service like WhatsApp, a payment provider like PayPal, or an online marketplace like eBay—there’s always a central party involved. This intermediary stores information, charges fees, or determines which users are allowed to participate in the system through account verification.

Private Key and Public Address

The peer-to-peer (P2P) system leads to a decentralized account structure. In centralized systems, accounts are opened through an intermediary—for example, when you open a bank account or create an email address. The intermediary can check for duplicate accounts and collect personal data in the process. In the decentralized blockchain system, however, accounts are created randomly through cryptography, without any cross-checking between users.

When you create a blockchain account, you’re given a randomly generated private key.

The private key is used to digitally sign all your transactions on the blockchain network, serving as proof that you truly own the Bitcoin (or other assets) you’re sending. Put simply, you can think of the private key as the password to your balance on the blockchain. The private key consists of a string of 64 characters, made up of numbers and letters.

From this private key, a so-called public address is derived, functioning much like an email address relates to a password and representing the user’s account within the system. This derivation is strictly one-way—it’s impossible to calculate the private key starting from the public address. If information, such as the ownership of Bitcoin, needs to be transferred, it’s sent to a person’s public address.

Example: If Sarah wants to transfer two Bitcoin to Karl, she automatically signs the transaction with her private key and specifies Karl’s public address as the new owner. Only Karl, using his own private key, can then access the funds and make further transactions.

Regardless of this, everyone can view the transactions between all addresses. This transparency is based on the principle of the Distributed Ledger Technology, which will be explained in the following section.

So far, we’ve established that we’re dealing with a P2P system in which participants interact through cryptographically secured accounts.

Distributed Ledger

A distinctive feature of the system is the way information is processed and recorded. This happens through what’s known as a Distributed Ledger, which can be thought of as a decentralized ledger replacing the system’s central server. Two key characteristics define it.

First, every new piece of information receives a separate entry in the ledger—even if the prior information was merely updated or nullified. Once written, entries in the ledger cannot be changed (more on that later). Instead, any change is recorded as a new entry that references the adjustment to the previous data.

For example, if Sarah transfers two Bitcoin to Karl, this transaction is recorded as an entry. If Karl then sends the two Bitcoin back to Sarah, restoring the original balance, the previous entry isn’t deleted. Instead, a new entry is added stating that the two Bitcoin were transferred back from Karl to Sarah.

Secondly, the entire ledger is updated, copied, and separately distributed to everyone actively participating in the operation of the blockchain each time a new entry is made. This process helps ensure an essential aspect of decentralization.

Returning to our earlier example: if Sarah were to try to commit fraud by claiming that she never received the two Bitcoin back from Karl, her lie could be exposed. This is because there’s a decentralized and publicly accessible ledger where all information—and every transaction—is permanently documented.

So, to sum up: we’re dealing with a tamper-proof and transparent P2P system in which information is decentrally documented, and participants interact through cryptographically secured accounts.

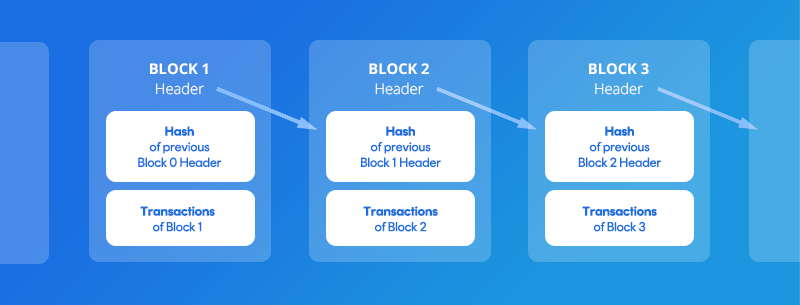

Why the Name Blockchain?

Let’s now look at the entries in the ledger that give the blockchain—literally, the “chain of blocks”—its name. Each entry consists of multiple pieces of information combined into a block. These blocks are arranged in sequence by cryptographically linking each new block to the previous one. This creates an immutable chain, where earlier entries can no longer be changed.

This unchangeability comes from the way blocks are connected through one-way cryptographic linking. When a block is created, it’s assigned specific data, including a header, an ID, a timestamp, a unique hash value, and a reference to the hash value of the preceding block.

Hash Values and Cryptography

A hash is a value generated through complex mathematical algorithms from digital content—in this case, the information contained within a block. The hash value always remains the same as long as the content doesn’t change, and you can consistently calculate the same hash from the same content. However, it’s impossible to reverse-engineer the original content from the hash value alone.

A simple analogy is the concept of a digit sum. For example, if the contents of a block consist of the numbers 1, 3, and 4, the digit sum—similar to a hash—would be 8. From the original numbers, you can always calculate the sum. But the reverse isn’t possible because the digit sum 8 could also result from other combinations like 2, 2, 4 or 1, 1, 6. In reality, the functions used to calculate hash values are far more complex and secure, making any content changes immediately detectable.

Bitcoin, for instance, uses the SHA-256 algorithm. One crucial aspect of hashing is collision resistance, meaning it’s virtually impossible for two different contents to produce the same hash value.

Each block thus has a unique digital fingerprint created by its hash, which not only identifies the block but also permanently links it to neighboring blocks. If someone tried to alter information in an old block, all subsequent blocks would “notice” the change because the hash of every affected block would change as well.

So, to sum up: we’re operating in a tamper-proof and transparent P2P system where information is decentrally and immutably recorded, and participants interact through cryptographically secured accounts.

The blockchain itself represents the chain of blocks linked together via hash values, each block containing the information that makes up the distributed ledger.

Mining – The Blockchain’s Reward System

The value of the blockchain lies, among other things, in the secure recording of information within its blocks. However, creating a block—including calculating its hash—requires significant computational effort. The larger a blockchain grows, the more complex this process becomes. So the question arises: Who provides the computational power to generate the blocks and keep the system running? This brings us to the concept of miners.

Miners are participants in the blockchain network who voluntarily contribute their computing power to validate transactions and create new blocks. They are essential for the system’s operation. To ensure there are enough miners, they’re offered a financial incentive. Each miner receives a certain amount of the network’s native coins—commonly known as cryptocurrencies—as a reward, which can then be monetized.

Since there can be multiple participants in the blockchain who want to perform this profitable computational work, a competition arises. On the one hand, this ensures that only one block is added to the chain at any given time. On the other hand, it determines which participant wins the right to add the block. This process of reaching agreement among miners is called consensus.

There are different methods used to achieve consensus in blockchain networks.

Proof of Work

In this context, we’re talking about the mechanism used by Bitcoin: Proof of Work (PoW). In PoW, the determining factor for who wins the right to add the next block is computational effort. Participants (or rather, their hardware) must solve complex mathematical problems, which essentially involve guessing specific hash values. These calculations run automatically via processing power. Whoever solves the problem first wins the right to create the new block.

Once the winner has generated the block, they share it with other miners in the system for verification. After a certain number of checks, the block and the information it contains are considered valid. This process starts anew with each subsequent block.

The PoW algorithm (and the significant computational effort it requires) also helps prevent so-called Sybil attacks. In a Sybil attack, countless fake participants are created in an attempt to manipulate majority voting processes—for example, decisions on whether a block is valid.

To sum up: we’re dealing with a tamper-proof and transparent P2P system where information is decentrally and immutably recorded, and participants interact through cryptographically secured accounts. The blockchain consists of blocks linked through hash values, each containing information from the distributed ledger. These blocks are created by network participants called miners, who receive cryptocurrencies (e.g., Bitcoin) as a reward. A consensus algorithm (such as Proof of Work) determines, through specific mechanisms, which participants are selected to add new blocks.

Origin of Blockchain

Blockchain has the potential to become a foundation for global data recording and storage. It first became widely known in 2008 with the publication of Bitcoin by an individual or collective operating under the pseudonym Satoshi Nakamoto.

1991

1998

2000

2004

2008

2009

2014

Applications of Blockchain

Blockchain offers countless potential applications, many of which have yet to be fully realized, while a significant number of projects remain in the planning and development stages.

On its own, the technology provides fascinating use cases, but its true potential unfolds when combined with other technologies like the Internet of Things (IoT), artificial intelligence (AI), or modern RFID and sensor technologies.

Moreover, several necessary regulatory hurdles still need to be overcome over time. Fundamentally, blockchain is best suited for environments where multiple parties share the same goal but may distrust one another for various reasons. In blockchain-based ecosystems, parties can collaborate quickly and efficiently without doubt or mistrust.

Industries and Projects

Real Estate: Land registries, property rights, notary services, crowd investing (e.g. Rentberry, Propy, Atlant)

Identity: Personal identification, driver’s licenses, and more (e.g. Civic, Stacks)

Healthcare Data/History: Secure sharing of patient records for doctors and hospitals

Logistics and Supply Chains: Retail, container logistics, and more

Internet of Things (IoT): Machine-to-machine communication and payments (e.g. IOTA)

Cloud Computing: Renting and providing computing power (e.g. Golem)

Data Storage: Decentralized data storage solutions (e.g. Filecoin, Storj, SIA)

Political Elections & Voting

Predictions/Forecasting: Decentralized prediction markets (e.g. Polymarket)

Financial Products: Stocks, ETFs, mutual funds, and more

Social Media: Decentralized platforms (e.g. Farcaster, Status, Lens Protocol)

Decentralized, Censorship-Resistant Internet: Tools for private and open internet access (e.g. Brave Browser & Basic Attention Token, Substratum)

…and many more.

The projects listed above are just a small sample of the many different ideas aiming to leverage the concept of blockchain. It remains to be seen how many of the countless ideas and projects in this space will deliver real, long-term value.

So far, Bitcoin remains the only fully functioning and widely adopted use case of blockchain technology.

Do you really need a Blockchain?

The ecosystem around blockchain and decentralized networks is still in its infancy and constantly evolving. While it certainly has the potential to disrupt many areas of our systems, it shouldn’t be viewed as a universal solution for all problems.

Blockchains have many disadvantages compared to traditional (relational) databases and should only be used when a fundamental trust issue—such as the need for censorship resistance—is the core challenge among the participating parties.

About the author

Hi, I'm Philipp. 👋

Founder coinbird.com

With over 15 years of experience in the IT sector, I love building easy-to-use digital products that actually help people. In 2017, I fell down the Bitcoin rabbit hole and gradually realized that the crypto world lacked simple, user-friendly tools for everyday people. That’s why I created coinbird.com – to make crypto easier to understand, more accessible, and transparent.

LinkedIn