What is the Bitcoin Fear & Greed Index?

The Bitcoin Fear & Greed Index is a popular indicator that can help you understand the current sentiment in the crypto market. It measures daily emotions and sentiment on a scale from 1 to 100, ranging from extreme fear to extreme greed.

High levels of fear can lead to falling prices, while excessive greed often contributes to overheated markets and inflated prices. The Fear & Greed Index draws on various data sources—such as current trends, social media activity, volatility, market momentum, and trading volume—to create as accurate a picture of market sentiment as possible. It offers insights into whether the Bitcoin and broader crypto market is currently driven by irrational fear or unchecked greed.

Table of contents

What can you use the Fear & Greed Index for?

Understand market sentiment: The index helps you get a sense of the overall mood in the market. Is the current sentiment driven by fear or greed? This can help you adjust your strategy accordingly.

Make buy and sell decisions: Some investors use the index as a contrarian indicator. Extreme greed might signal an upcoming downturn, while extreme fear could point to a potential recovery. However, caution is advised—the index is just one tool among many.

Manage risk: The index can also help you better assess your personal risk exposure. When the market becomes overly greedy, you might consider taking some profits off the table before a possible correction.

Identify long-term trends: The Fear & Greed Index can help spot longer-term sentiment trends in the market, which is especially useful if you’re following a long-term investment strategy.

The 5 Phases of the Fear & Greed Index

| Fear & Greed Phase | Index Value | Color | Market Sentiment |

|---|---|---|---|

| Extreme Fear | 0-24 | Dark Red | Extreme Fearful |

| Fear | 25-44 | Red | Fearful |

| Neutral | 45-54 | Yellow | Neutral |

| Greed | 55-74 | Green | Euphoria |

| Extreme Greed | 75-100 | Dark Green | Extreme Euphoria |

Extreme Fear

The “Extreme Fear” state signals a highly anxious mood in the market. During this phase, investors are often overly worried, leading to heavy selling and price declines. It’s a time dominated by pessimism, and the market may be undervalued.

Fear

In the “Fear” phase, market sentiment is still marked by concern and caution, though not as intense as in “Extreme Fear.” Investors are wary, which can result in subdued trading activity. It’s a period of uncertainty, suggesting the market might be going through a rough patch.

Neutral

The “Neutral” state of the index indicates balanced market sentiment. Neither extreme fear nor greed dominates, pointing to a stable market. In this phase, investors’ decisions tend to be less driven by emotion and more based on rational analysis.

Greed

The “Greed” phase signals growing optimism and confidence in the market. Investors are often more willing to invest, driving prices higher. While it’s a time of optimism, caution is still advised, as excessive greed can lead to overvaluation.

Extreme Greed

“Extreme Greed” is the opposite of “Extreme Fear.” Here, the market sentiment is extremely positive, raising the risk of market exuberance. Investors often become blind to risks, potentially causing prices to soar disproportionately and creating a bubble.

Data and Calculation of the Fear & Greed Index

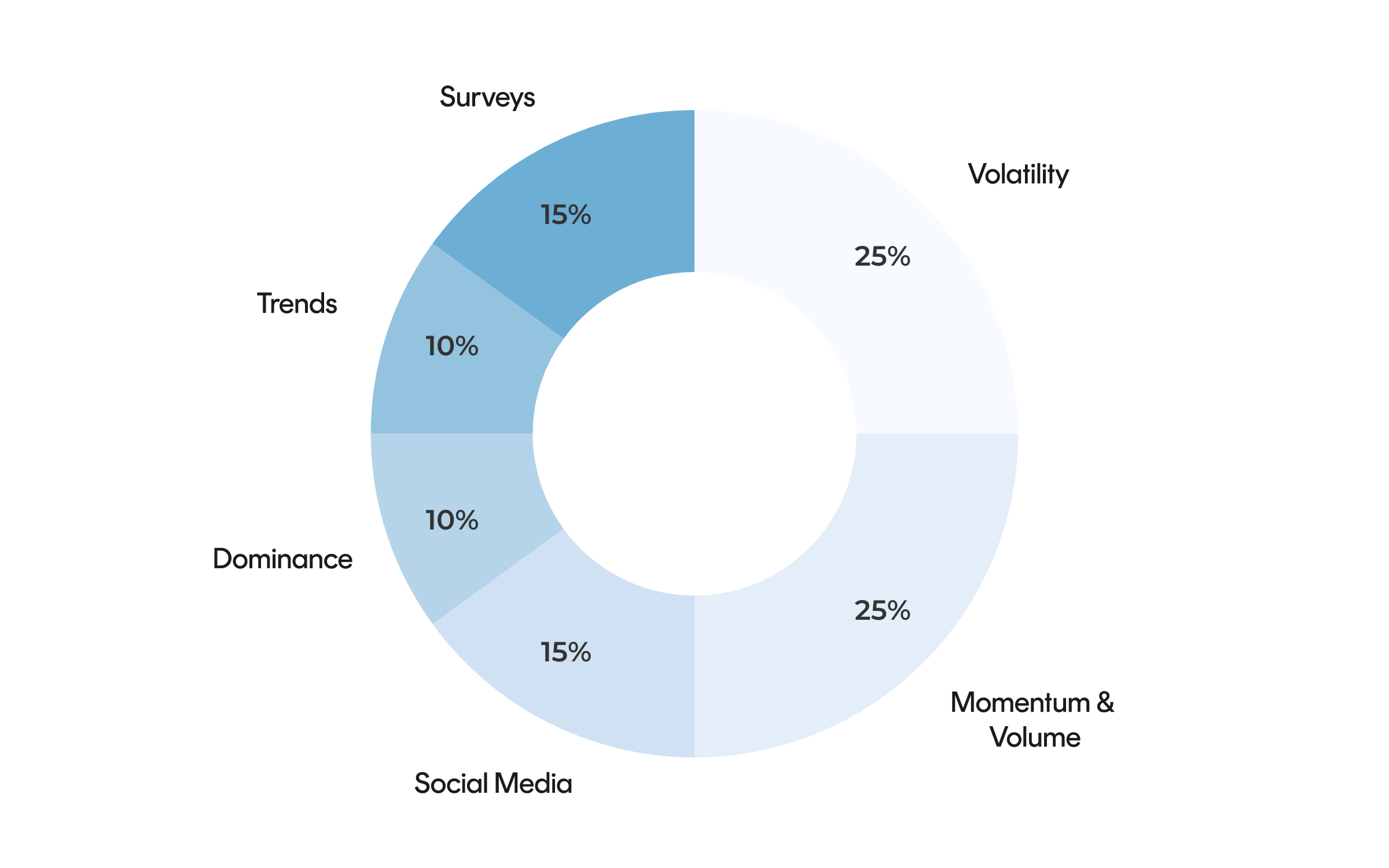

There’s no single formula for the Bitcoin Fear & Greed Index. Different models and weightings produce slightly varying values, but interestingly, the results are usually quite close. The index serves more as a rough guide to reflect market sentiment. Let’s look at the components that go into calculating the Fear & Greed Index:

Volatility (25%): Compares Bitcoin’s current volatility to that of the past 30 and 90 days. High volatility often signals heightened fear in the market.

Momentum and Volume (25%): Assesses buying momentum and trading volume based on data from the past 30 and 90 days. High buying volume during momentum phases can be a sign of prevailing greed.

Social Media (15%): Primarily based on Twitter data. A high number of posts and interactions around Bitcoin can indicate increased interest and, therefore, greed.

Dominance (10%): If Bitcoin gains dominance over altcoins, it suggests investors are seeking a “safe haven” out of fear. Conversely, if Bitcoin loses dominance, it can point to a greedier sentiment, with investors moving into riskier altcoins.

Trends (10%): Analyzes Bitcoin-related search terms on Google to determine whether fear or greed dominates the market, based on search volumes and topics.

Surveys (15%): Survey data is currently suspended from the index but could play a role again in the future. Previously, simple user surveys were used to capture market sentiment toward Bitcoin.

Limitations and Criticism

While the Fear & Greed Index is a popular tool for gauging sentiment in the Bitcoin market, there are several criticisms and limitations:

Subjectivity: The interpretation of the data can vary, leading to different assessments.

Incomplete picture: The index doesn’t capture all factors influencing the market, such as political or economic events.

Reliance on the past: It heavily relies on historical data, which doesn’t always predict future developments.

Oversimplification: Some critics view the index as an overly simplified representation of complex market sentiment.

Self-fulfilling prophecy: Widespread use of the index could steer market sentiment in the direction it predicts.

Despite these limitations, the index is a useful tool but should be viewed as part of a broader analysis.

Conclusion

The Fear & Greed Index serves as a kind of psychological barometer for sentiment in the Bitcoin market. It combines various data sources and indicators to measure the prevailing emotions among investors—fear and greed.

Despite its usefulness, it’s important to be aware of its limitations. The index is a helpful tool but not a comprehensive indicator and should never be the sole basis for investment decisions. It’s best used as part of a broader market analysis that takes other factors and developments into account. In the fast-moving world of cryptocurrencies, having a well-rounded perspective is crucial for making informed decisions.

Sources

alternative.me (data source for the Fear & Greed Index)

About the author

Hi, I'm Philipp. 👋

Founder coinbird.com

With over 15 years of experience in the IT sector, I love building easy-to-use digital products that actually help people. In 2017, I fell down the Bitcoin rabbit hole and gradually realized that the crypto world lacked simple, user-friendly tools for everyday people. That’s why I created coinbird.com – to make crypto easier to understand, more accessible, and transparent.

LinkedIn