What is Bitcoin?

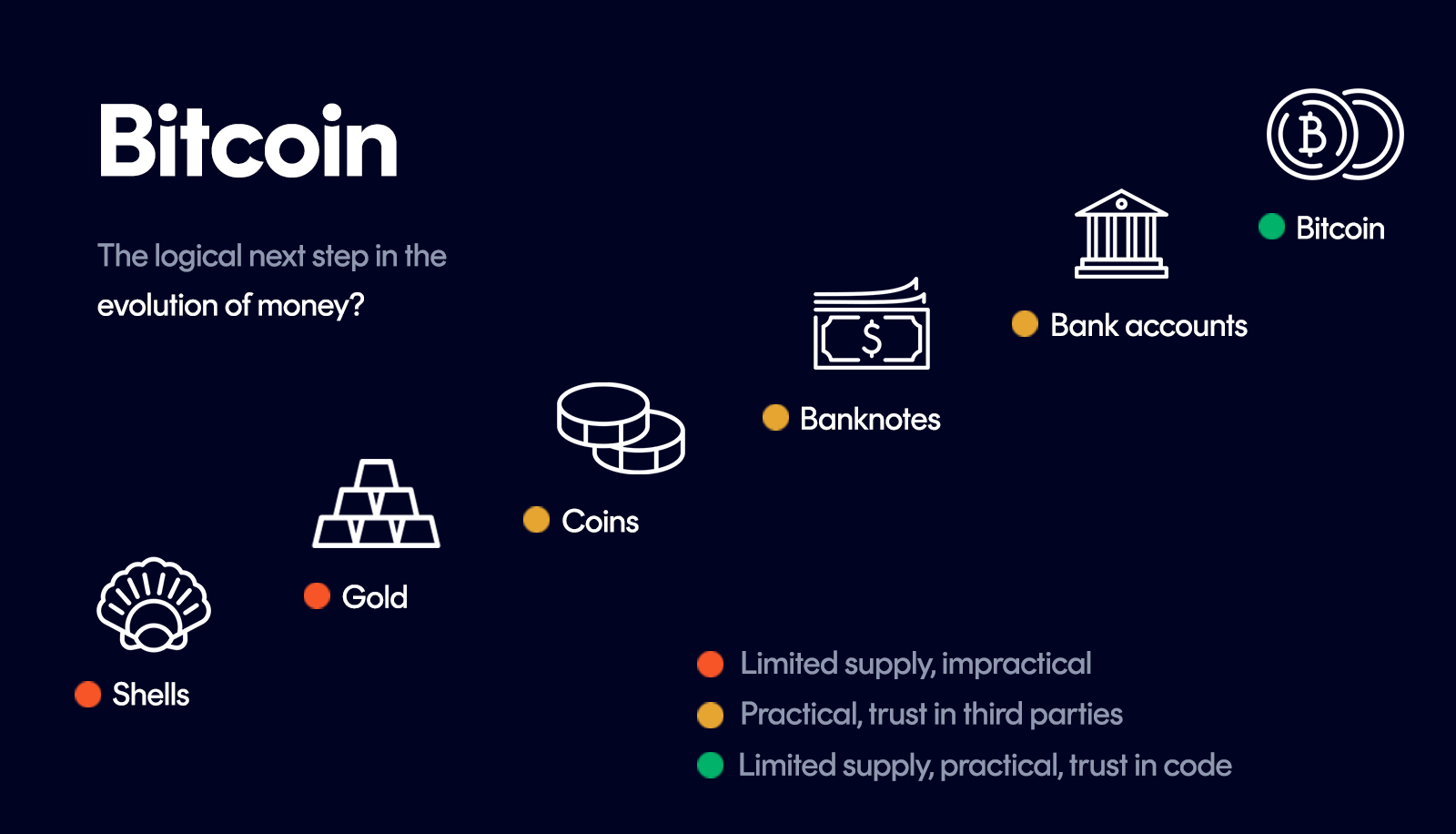

Bitcoin (BTC) is the original cryptocurrency—and still the most influential. It's a decentralized, censorship-resistant digital currency built on blockchain technology. It's not controlled by any government or central bank. Bitcoin is resistant to inflation by design, thanks to a hard cap of 21 million coins set by its creator, Satoshi Nakamoto.

Table of contents

Bitcoin cannot be physically printed or controlled, regulated, or manipulated by a central bank or any other central institution. Nevertheless, the currency can be used like any other for purchasing goods, services, or as a long-term store of value—often referred to as "digital gold."

The foundation of Bitcoin is the so-called blockchain. Its name comes from cryptographically linked blocks that contain transaction data. This decentralized ledger is not subject to government control or any central bank that could control the money supply or set regulatory frameworks. The network is therefore self-regulating and protected from inflationary fluctuations or government interference.

Pioneer of cryptocurrencies

Bitcoin is the world's first cryptocurrency and still shapes many of the core ideas behind blockchain and digital currencies today. The Bitcoin network has by far the most participants and is widely considered the most secure, stable, and censorship-resistant cryptocurrency. In media coverage and public discussion, Bitcoin remains the go-to example that represents the entire crypto space.

However, the theoretical construct on which Bitcoin is based dates back to the 1990s. The theory was only implemented with the publication of Bitcoin in 2008 and implemented as a functioning system in 2009. This makes Bitcoin not only the pioneer among digital currencies but also defines exactly the standard on which most later cryptocurrencies have been built. The origin of Bitcoin is also shrouded in mystery. To this day, no one can say with certainty which person is really behind Bitcoin's development.

Bitcoin was introduced by Satoshi Nakamoto in a now-famous whitepaper. Whether this name represents a single developer or a group remains unclear. Countless theories circulate online about who might have created Bitcoin, but no definitive answer exists.

What is certain, however, is that the first Bitcoin were mined in early 2009 and billions of transactions have been conducted since then. During this time, the blockchain grew to an impressive 210 gigabytes, with Bitcoin now dominating the digital currency market.

How many Bitcoin are there?

The total number of Bitcoin is limited to just under 21 million Bitcoin, making it a (mathematically) limited resource. Projections suggest that the last Bitcoin will probably be mined around 2140. Smaller Bitcoin amounts are also often expressed in "Satoshi." One Satoshi equals one hundred-millionth of a Bitcoin and is the smallest unit that can be recorded on the blockchain. The unit's name is a tribute to the currency's mysterious creator.

Is Bitcoin anonymous?

Bitcoin is considered pseudonymous. Although Bitcoin's rise originally began in the darknet, the popular currency is nowadays used less as an anonymous payment method for illegal transactions.

The reason for this lies in the nature of the Bitcoin blockchain. Every transaction is stored transparently in it. A transaction includes both the amount of Bitcoin transferred and the data of the sender and recipient. While no names are displayed in plain text on the blockchain, it is technically possible to associate Bitcoin addresses with real people. Therefore, Bitcoin is only conditionally attractive for illegal activities such as money laundering or drug trafficking. Moreover, there are now other currencies like Monero, Zcash, or Dash that offer a much higher degree of anonymity. However, there are now also ways to obscure Bitcoin transactions using special methods (e.g., CoinJoin, Bitcoin mixing).

How does Bitcoin work?

To fully understand how Bitcoin works, understanding and considering three key technologies is essential: blockchain technology, the concept of private and public keys, and the mining process. These technologies are fundamental to Bitcoin's design and function and ensure its censorship resistance, security, and decentralization.

Blockchain

Private and public keys

Bitcoin Mining

You can find more detailed information about how the technology behind Bitcoin works in our blockchain article or in the official Bitcoin Whitepaper.

The advantages of Bitcoin

Bitcoin's decentralized and manipulation-proof architecture reduces the need for intermediaries such as banks or credit institutions. This eliminates many of the high fees typically charged for cross-border transactions.

The fact that all transactions must be signed gives participants the security that the transaction actually reaches the desired recipient. Additionally, transactions within the network are processed and confirmed within minutes, without detours.

Bitcoin advantages at a glance

Censorship-resistant and manipulation-proof

Decentralized: Bitcoin is not controlled by any single entity or company; the network belongs to "everyone and no one"

Permissionless - Anyone can participate in the financial system, even without a bank account

Global network for value transfer and storage

Protected from severe inflation through limitation of total supply in the protocol code

Use cases for Bitcoin

To understand the advantages and benefits of Bitcoin as a global, neutral, and open payment network, some concrete examples can be helpful:

Alternative currency during high inflation: Massive currency devaluations and inflation occur repeatedly in many countries worldwide. Bitcoin can provide people locally with a neutral escape currency to avoid currency devaluation.

Fleeing from a country: When fleeing a country due to wars or a politically difficult situation, assets can be carried across borders easily and without the risk of confiscation. Gold or cash in large amounts could quickly be confiscated or even stolen.

Financial inclusion: About 1.7 billion people worldwide lack access to banking services (Source: paymentandbanking.com). Bitcoin allows people to access the financial system without needing permission—and without the risk of censorship.

International payments: Many people work abroad and send money to their families back home. Previously, these transactions usually went through expensive and slow payment service providers. Through Bitcoin, people can transfer value globally cost-effectively, censorship-free, and lightning-fast.

Buying and storing Bitcoin

You can buy Bitcoin on various exchanges and brokers. You can find an overview of reputable providers in our crypto exchange comparison. If you're unsure when the best time to buy is, you can instead simply set up a monthly savings plan. More information can be found in our Bitcoin DCA calculator.

Instructions for Buying Bitcoin

Register: Sign up with a trustworthy crypto exchange with a good reputation.

Verify: Verify yourself by uploading a photo ID and go through the KYC process. KYC, or "Know Your Customer," is a verification process that exchanges are required to complete to prevent, for example, money laundering.

Deposit Money: Deposit dollars or euros into your account on the exchange via bank transfer, credit card, or PayPal. Most exchanges offer a variety of deposit options.

Buy Bitcoin: Once your account on the exchange is loaded with dollars or euros, you can buy Bitcoin for any amount with just a few clicks.

Securely storing Bitcoin with a Wallet

For smaller amounts, it's perfectly fine to store the purchased Bitcoin on the exchange you used. If you've invested significant amounts in Bitcoin, it's advisable to use a Bitcoin wallet for independent storage, because in case of sudden insolvency of the crypto exchange or a hacker attack, you could lose access to your Bitcoin.

When choosing a suitable wallet, you can decide between a simple, free software wallet (wallet app for desktop or mobile devices) or a hardware wallet (physical stick). You can find all important information, explanations, tips, and comparisons in our comprehensive crypto wallet comparison.

Bitcoin's weaknesses

Bitcoin has certain limitations that were intentionally built into the protocol. As user numbers grow, so does transaction volume. This high demand means transactions often can't be processed fast enough anymore.

The root of the problem lies in the protocol's block size limit, which simply can't keep up with current demand. The block size was capped at 1 MB back in 2010, meaning any larger blocks get rejected. This measure was originally designed to prevent hackers from overwhelming the system. However, this now acts as a bottleneck for the network and increasingly frustrates users. During peak times, it's common for users to wait several hours for their transactions to go through. Many Bitcoin developers and teams are currently working on solutions to these scaling challenges. One of the most promising projects is the Lightning Network.

Lightning Network: The solution to scaling problems?

What is the Lightning Network?

The Lightning Network is a second-layer solution built on top of Bitcoin that aims to make transactions faster and more cost-effective. It functions as a kind of second layer on the Bitcoin blockchain and enables users to send and receive lightning-fast payments with very low fees.

How does the Lightning Network work?

Users can open so-called payment channels between themselves that operate outside the main blockchain. Within these channels, they can conduct any number of transactions without each one having to be recorded on the blockchain. Only when opening and closing a channel do transactions occur on the blockchain, which reduces network traffic and lowers costs.

Advantages of the Lightning Network

Speed: Transactions are processed almost instantly

Cost efficiency: Significantly lower fees compared to normal Bitcoin transactions

Less network burden: Reduces congestion on the main blockchain, benefiting all users

How big is the Lightning Network currently?

The total value of Bitcoin in the Lightning Network currently amounts to about 5,000 Bitcoin, which corresponds to approximately $300 million USD. The Lightning Network currently comprises over 15,000 nodes and about 50,000 channels.

(As of: May 16, 2024, Sources: bitcoinvisuals.com, 1ml.com)

Bitcoin's energy consumption

How high is Bitcoin's energy consumption?

According to the Cambridge Center for Alternative Finance (CCAF), the Bitcoin network's energy consumption is currently about 115 TWh per year (terawatt hours). That's about 0.55% of global energy production and corresponds to the energy needs of a smaller country like Sweden or Malaysia.

Criticism of mining's energy consumption

The energy consumption of Bitcoin mining is a point of criticism that is repeatedly picked up by the media and hotly debated. Indeed, the consensus algorithm "Proof of Work," which arguably makes it the most secure network in the world, is very energy-hungry. This is also intentional: the energy expenditure in Proof of Work makes spam and manipulation attacks on the Bitcoin blockchain extremely costly and nearly impossible.

About 52% of miners (Source: CCAF) now use sustainable energy sources, including renewable energy (42.6%) and nuclear power (9.8%). Often, excess electricity that would otherwise go unused can be channeled into mining, making the process both cost-effective and environmentally friendly. In countries like Iceland, natural conditions make green energy mining particularly affordable.

Ironically, Bitcoin could end up driving the adoption of cleaner energy sources, making renewable electricity generation more attractive and economically viable.

Nevertheless, the majority of the mining industry still relies on fossil fuels, with natural gas (38.2%) having replaced coal (8.9%) as the dominant non-renewable energy source. While this shift represents progress, these energy sources still contribute to environmental concerns, which is why criticism of Bitcoin's energy consumption remains partially justified.

Bitcoin mining energy consumption over time

Recent studies show that while Bitcoin's total energy consumption has grown with network security, the sustainability profile of Bitcoin mining has been steadily improving. The increasing adoption of renewable energy sources indicates a positive trend toward more environmentally responsible mining practices.

Frequently asked questions about Bitcoin

What is the current price of Bitcoin?

The current price of Bitcoin is $66,255.00. Over the past 24 hours, the price is down 1.69%, with a trading volume of $56.04B. Bitcoin remains the largest cryptocurrency by market cap, currently at $1.32T.

Is it worth investing in Bitcoin?

The price change of Bitcoin (BTC) over one year is currently -32.10%, making Bitcoin a bad investment in hindsight. Whether this trend will continue in the future depends on many external factors such as supply and demand. Past price trends are no indicator of future performance.

Where can I buy Bitcoin?

The best and most reputable crypto exchanges for buying Bitcoin include ones such as Kraken and Coinbase. You can find more in our comparison of crypto exchanges.

Which Bitcoin wallet is the best?

The best hardware wallets for Bitcoin are Ledger Nano X, BitBox02 and Trezor Model T. In our opinion, the best software wallet for Bitcoin is the Zengo app. You can find more in our comparison of crypto wallets.

What was the all-time high of Bitcoin?

The Bitcoin (BTC) cryptocurrency all-time high is $126,080.00. This price was reached on Oct 06, 2025. The current price is $66,255.00, a difference of -47.45% from the all-time high.

Who has invested in Bitcoin?

Bitcoin's early investors include institutional investors and venture capitalists (VCs) such as Galaxy Digital, Placeholder VC, Paradigm, Pantera Capital, Delphi Digital, Jump Capital.

How many Bitcoin (BTC) are currently in circulation?

There are currently 19.99M Bitcoin (BTC) in circulation. The total amount of BTC in circulation represents all coins and tokens that have already been distributed and are therefore held in the wallets of private individuals, companies or institutions.

What is the Total Value Locked (TVL) of Bitcoin?

The Total Value Locked of Bitcoin (BTC) is currently $4.93B. This value includes all assets locked on the blockchain or in DeFi protocols. With a market cap of $1.32T, this results in a ratio of market cap to TVL of 268.63.

How many active addresses (24h) does Bitcoin have?

As of the last update, Bitcoin had about 659,141 active addresses (24h) — the number of unique addresses that sent or received a transaction in a rolling 24-hour window (each address counted once). Note: addresses ≠ users (one person or an exchange can control many).

How many transactions per day are running on Bitcoin?

Bitcoin currently has an average of around 451,472 transactions per day. This key figure indicates how many network transactions have taken place on average per day in the last 3 months.