What is Uniswap?

Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain. It lets you trade Ethereum-based tokens (ERC-20) 24/7 — without relying on a middleman. You can also contribute your tokens to liquidity pools and earn a share of the trading fees in return.

Table of contents

Unlike traditional exchanges, Uniswap uses an Automated Market Maker (AMM) model. Instead of relying on order books, prices are calculated algorithmically based on the available liquidity in smart contract-powered pools. The platform’s native token, UNI, plays a key role in governing the protocol, giving holders a say in important decisions.

Why was Uniswap created?

Centralized crypto exchanges like Coinbase, Binance, or Kraken still dominate the trading of digital assets. But when you trade on those platforms, you need to deposit your crypto there and trust the platform to keep it safe. This dependency comes with serious downsides.

The biggest issue is the custody risk of your assets. Once you’ve transferred your crypto to a centralized exchange, you lose direct control. The platform could be hacked, go bankrupt, or freeze your funds for various reasons. Well-known cases like Mt. Gox, where around 850,000 Bitcoin were lost in 2014, or the spectacular collapse of FTX in 2022, which resulted in billions in losses, show just how real this risk is.

Centralized exchanges also often charge high trading fees, typically between 0.1% and 1% per trade. You have to verify your identity through KYC procedures, which compromises your privacy. The range of available tokens is limited to what the exchange chooses to list. And if the platform experiences technical issues or maintenance, you may not be able to trade — which is especially frustrating during volatile market conditions.

DEXs like Uniswap aim to solve these issues by letting your crypto stay in your own wallet at all times — so you retain full control.

Earlier decentralized exchanges that used order books had their own weaknesses: low liquidity, particularly with lesser-known token pairs, often resulted in poor pricing and high slippage. This is where Uniswap’s innovative AMM model comes into play.

The AMM model and smart contract architecture

How Automated Market Makers (AMMs) work

Uniswap revolutionized decentralized trading with its AMM system. Instead of waiting for buyers and sellers to match, you trade directly against liquidity pools.

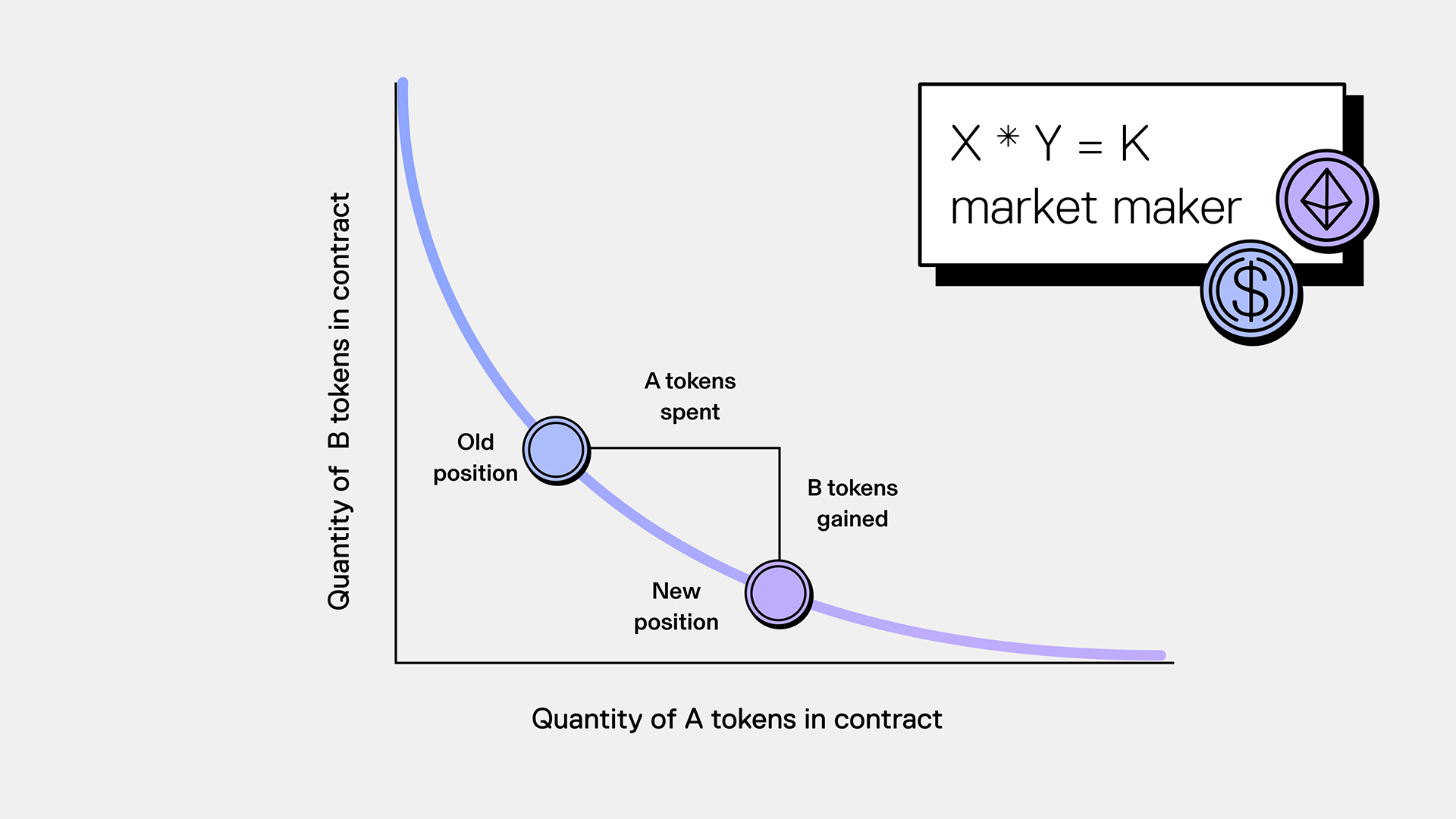

Each pool holds two tokens in a mathematically defined ratio. Prices are generated algorithmically using the formula x × y = k, where x and y represent the quantity of each token in the pool, and k is a constant. This ensures that every trade adjusts the balance of the pool while keeping the product constant — a simple but elegant mechanism at the heart of Uniswap.

In practice, this means: the more of a token you buy, the more its price increases. The market self-regulates through this automatic price adjustment. Large buy orders shift the balance of the pool and drive prices up, while sell orders have the opposite effect.

Smart contract architecture

Uniswap’s technical foundation consists of multiple smart contract components that work together seamlessly. At the core is the Factory Contract, which creates new liquidity pools. Each pool is managed by its own Pool Contract, responsible for storing the token pair and executing swaps. The Router Contract finds and routes the best available path across multiple pools — ensuring you always get the best price.

Security is a top priority. All contracts are open source and have undergone multiple audits. The mathematical structure of the AMM model helps protect against manipulation, and the contracts are immutable — meaning not even the Uniswap team can alter them once deployed.

Liquidity pools explained

How the pools work

To understand how liquidity pools operate, let’s look at a simple example. Imagine an ETH/USDC pool that contains 100 ETH and 300,000 USDC. The constant in this case — k — equals

100 × 300,000 = 30,000,000.

Now, let’s say you want to buy 10 ETH. After the swap, the ETH balance in the pool drops to 90, and the USDC balance must increase to 333,333 to keep k constant. That means you’d pay 33,333 USDC for 10 ETH — or an average price of 3,333 USDC per ETH.

Notice that this price is higher than the original pool price of 3,000 USDC per ETH. That’s automatic price adjustment in action — a direct result of how AMMs maintain balance.

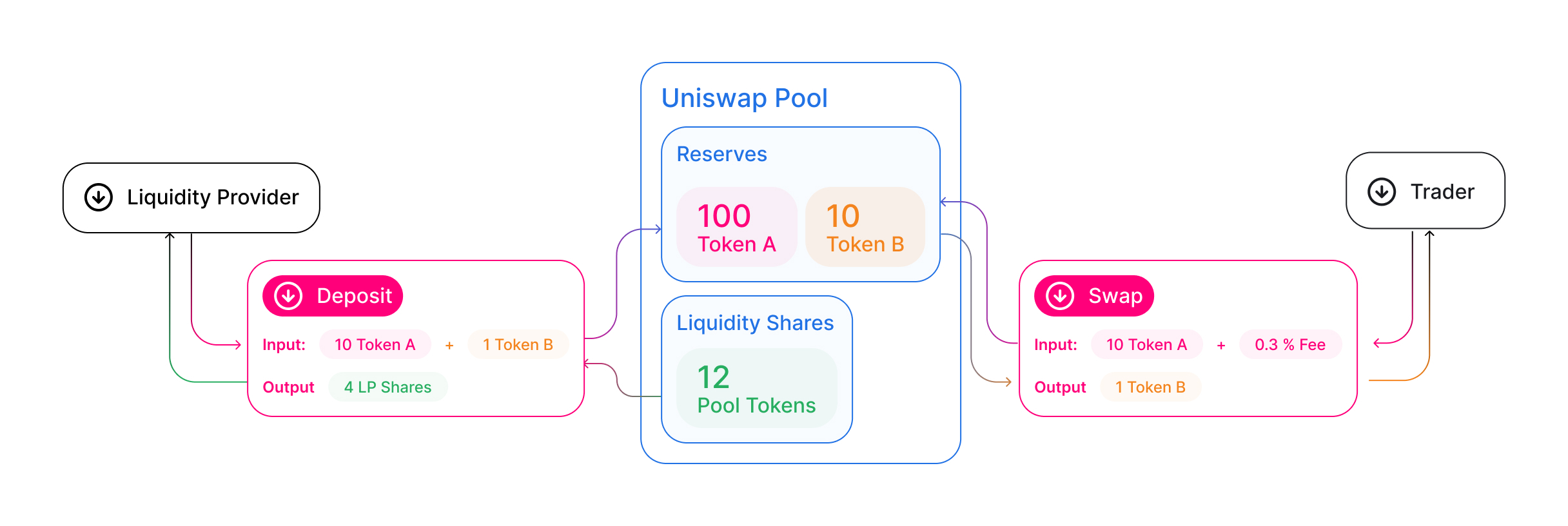

Providing liquidity

As a liquidity provider (LP), you can contribute assets to a pool and earn trading fees in return. The process is straightforward: you deposit both tokens in proportion to the current pool ratio. In our example, that means depositing 1 ETH and 3,000 USDC.

In return, you receive LP tokens as proof of your share in the pool. The amount is calculated using the formula √(amount of Token A × amount of Token B) – in this case, around 55 LP tokens. These represent your ownership in the pool. When you redeem them later, you’ll receive your proportional share of the pool’s current assets, plus the accrued trading fees.

Uniswap V2 vs V3

The evolution of Uniswap highlights just how quickly DeFi is advancing. Version 2, launched in 2020, introduced the core concept: liquidity is spread across the full price range, and each trade incurs a fixed 0.3% fee. The pool structure was intentionally simple to ensure security and ease of use.

Then came Version 3 in 2021 — a major leap forward:

Concentrated Liquidity. LPs can now allocate their funds to specific price ranges where liquidity is most needed, allowing for up to 4,000x greater capital efficiency. V3 also introduced variable fees (0.05%, 0.3%, or 1%), depending on the volatility of the trading pair.

Risks in detail

1. Impermanent loss

The biggest risk for LPs is what’s known as impermanent loss. This occurs when the prices of the tokens in your pool change at different rates. The term “impermanent” is misleading — the loss becomes very real if you withdraw your liquidity at the wrong time.

The math is harsh:

A 25% price divergence results in ~0.6% loss vs. simply holding

At 50%, the loss grows to 2%

A 2x price difference leads to 5.7% loss

A 5x difference results in a staggering 25.5% loss

In volatile markets, these losses can outweigh the fees you’ve earned.

2. Smart contract risks

Even though Uniswap is among the most audited protocols in DeFi, no code is 100% safe. Bugs can slip through, and V3’s added complexity (e.g., Concentrated Liquidity) introduces new potential attack vectors. There’s also composability risk — a vulnerability in another DeFi protocol interacting with Uniswap could impact its security.

3. MEV and front-running

Maximum Extractable Value (MEV) is a systemic issue across all blockchains. Specialized bots monitor the mempool for profitable trades. One common tactic is the sandwich attack: a bot places trades before and after yours, manipulating the price and leaving you with a worse deal.

To reduce risk, you can:

Use private mempools (e.g., Flashbots Protect)

Adjust your slippage tolerance

Split large trades into smaller ones

Still, MEV remains an unresolved challenge in decentralized trading.

4. Regulatory risks

The legal status of DeFi protocols is still uncertain in many jurisdictions. Governments may attempt to regulate or even ban DEX protocols. Certain tokens could become subject to compliance rules, and several lawsuits against DeFi projects are already underway. This regulatory uncertainty may impact Uniswap’s future.

Flash Swaps

Flash swaps are one of Uniswap’s most fascinating features. They allow you to borrow tokens from a pool without collateral — under one condition: everything must be paid back within a single transaction.

Here’s how it works:

You borrow tokens, perform any operations you want (e.g., arbitrage), and repay the borrowed amount plus fees. If you fail to repay, the entire transaction is automatically reverted — as if it never happened.

Use cases are diverse. Arbitrage traders use flash swaps to exploit price differences across DEXs. For example:

You borrow 100 ETH from Uniswap

Sell it on SushiSwap for 300,100 USDC

Buy back 100 ETH on Uniswap for 300,000 USDC

Keep the 100 USDC profit (minus fees) — all within one atomic transaction.

The UNI token

Function and utility

The UNI token is much more than a tradable asset. It grants holders true governance rights over the protocol. As a token holder, you can vote on major decisions — such as fee structures, revenue distribution, and new feature proposals.

The future potential is especially exciting. The community is discussing fee sharing for UNI holders, which would make the token a productive asset. Other ideas include staking mechanisms or a protocol-level insurance fund, though these have not been implemented yet.

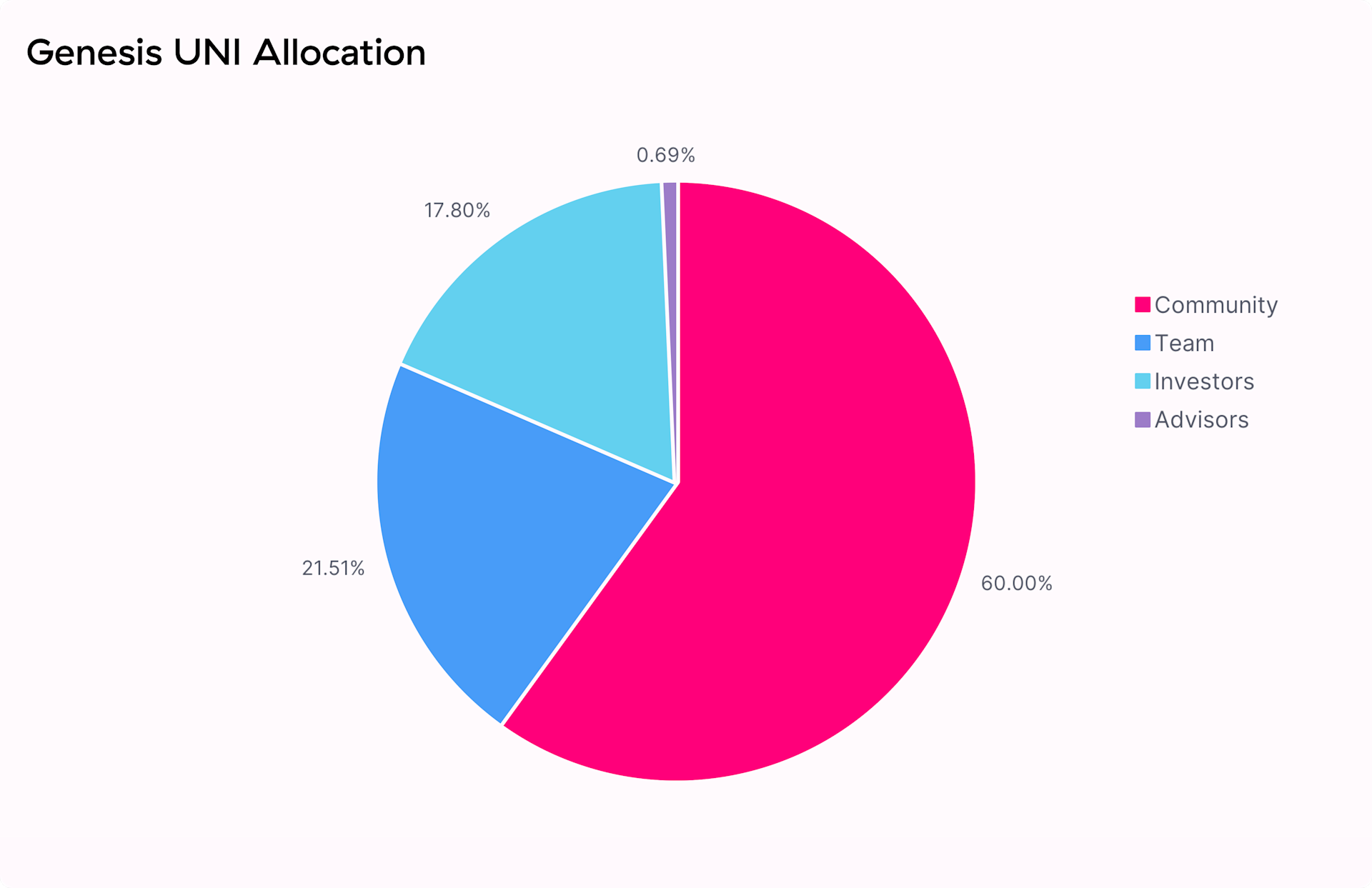

Tokenomics

The total supply of UNI is capped at 1 billion tokens, with a deliberately community-focused distribution. 60% went to the community through airdrops and liquidity mining programs. The team received 21.5%, and investors 18.5%, both subject to a four-year vesting period to ensure long-term alignment.

The governance process is well thought-out, but demanding:

Submitting a proposal requires 2.5 million UNI, and a minimum of 40 million UNI is needed for a vote to pass. The seven-day voting period gives the community enough time to discuss proposals and make informed decisions.

Ongoing development

Uniswap V4 (2024)

The next evolutionary step is already on the horizon. Version 4 introduces a revolutionary Hooks system that allows developers to embed custom logic directly into liquidity pools. This enables dynamic fees based on volatility, supports time-based trading strategies, and simplifies integration with other DeFi protocols.

Another major innovation is the singleton architecture, which brings all pools together in a single smart contract. This significantly reduces gas costs and makes multi-hop swaps across several pools far more efficient. These technical improvements could make Uniswap even more competitive — especially on Ethereum, where high gas fees remain a challenge.

Glossary

AMM (Automated Market Maker): Algorithm for automated price discovery

TVL (Total Value Locked): Total value of assets locked in the protocol

Slippage: Price deviation between expected and actual execution

LP Token (Liquidity Provider Token): Proof of your share in a liquidity pool

MEV (Maximum Extractable Value): Profit from reordering blockchain transactions

Impermanent Loss: Loss from divergent token price movement in a liquidity pool

Conclusion

Uniswap has redefined decentralized trading and is now the most important DEX protocol in the crypto ecosystem. The AMM model offers an elegant solution to the liquidity issues of early DEXs and enables trading around the clock — without any intermediaries.

For traders, this means instant execution, access to thousands of tokens, and no tedious sign-up processes or KYC. Liquidity providers earn passive income through trading fees, can enter and exit flexibly, and choose between different risk-reward profiles.

Of course, there are challenges. High gas fees on Ethereum can become prohibitive when network demand spikes. The risk of impermanent loss deters many potential LPs. MEV and front-running remain systemic problems. And the regulatory outlook is still uncertain in many regions.

Still, Uniswap remains a cornerstone of DeFi infrastructure. Its continuous development — from V2 to V3 to the upcoming V4 — and its expansion to other blockchains highlight the project’s strong momentum. With billions in TVL, Uniswap is well-positioned to remain a key player in the future of decentralized trading.

The platform appeals to both casual traders who simply want to swap tokens, and experienced DeFi users who want to put their assets to work. But it’s crucial to understand the risks and only invest what you can afford to lose.

DeFi offers great opportunity — but with great freedom comes great responsibility.

Frequently asked questions about Uniswap

What is the current price of Uniswap?

The current price of Uniswap is $3.40. Over the past 24 hours, the price is up 4.06%, with a trading volume of $56.04B. Uniswap is the 39th largest cryptocurrency by market cap, currently at $2.15B.

Is it worth investing in Uniswap?

The price change of Uniswap (UNI) over one year is currently -65.61%, making Uniswap a bad investment in hindsight. Whether this trend will continue in the future depends on many external factors such as supply and demand. Past price trends are no indicator of future performance.

Where can I buy Uniswap?

The best and most reputable crypto exchanges for buying Uniswap include ones such as Kraken and Coinbase. You can find more in our comparison of crypto exchanges.

Which Uniswap wallet is the best?

The best hardware wallets for Uniswap are Ledger Nano X, BitBox02 and Trezor Model T. In our opinion, the best software wallet for Uniswap is the Zengo app. You can find more in our comparison of crypto wallets.

What was the all-time high of Uniswap?

The Uniswap (UNI) cryptocurrency all-time high is $44.92. This price was reached on May 03, 2021. The current price is $3.40, a difference of -92.42% from the all-time high.

Who has invested in Uniswap?

Uniswap's early investors include institutional investors and venture capitalists (VCs) such as Andreessen Horowitz, a16z Crypto, Coinbase Ventures, Blockchain Capital, Pantera Capital, Paradigm.

How many Uniswap (UNI) are currently in circulation?

There are currently 633.86M Uniswap (UNI) in circulation. The total amount of UNI in circulation represents all coins and tokens that have already been distributed and are therefore held in the wallets of private individuals, companies or institutions.

What is the Total Value Locked (TVL) of Uniswap?

The Total Value Locked of Uniswap (UNI) is currently $3.14B. This value includes all assets locked on the blockchain or in DeFi protocols. With a market cap of $2.15B, this results in a ratio of market cap to TVL of 0.69.

How many active addresses (24h) does Uniswap have?

As of the last update, Uniswap had about 5,715 active addresses (24h) — the number of unique addresses that sent or received a transaction in a rolling 24-hour window (each address counted once). Note: addresses ≠ users (one person or an exchange can control many).

How many transactions per day are running on Uniswap?

Uniswap currently has an average of around 12,916 transactions per day. This key figure indicates how many network transactions have taken place on average per day in the last 3 months.