What is Polkadot?

Polkadot is a multi-chain blockchain protocol that enables different blockchains to securely connect and communicate with each other. The system was developed to solve the problem of blockchain isolation and create a scalable infrastructure for specialized blockchains.

Table of contents

What problem does Polkadot solve?

Many blockchain projects face two fundamental challenges: security and interoperability. New blockchains must build their own validator network, which is expensive and risky—especially for smaller projects that lack sufficient resources to ensure adequate security.

Additionally, blockchains cannot communicate with each other by nature. Each chain is an isolated system, making it extremely difficult to develop complex, cross-chain applications.

Polkadot solves both problems through a shared security model: New blockchains can "rent" the security of the Polkadot network instead of building their own validator network. At the same time, the shared infrastructure enables native interoperability between all connected chains.

How does Polkadot work?

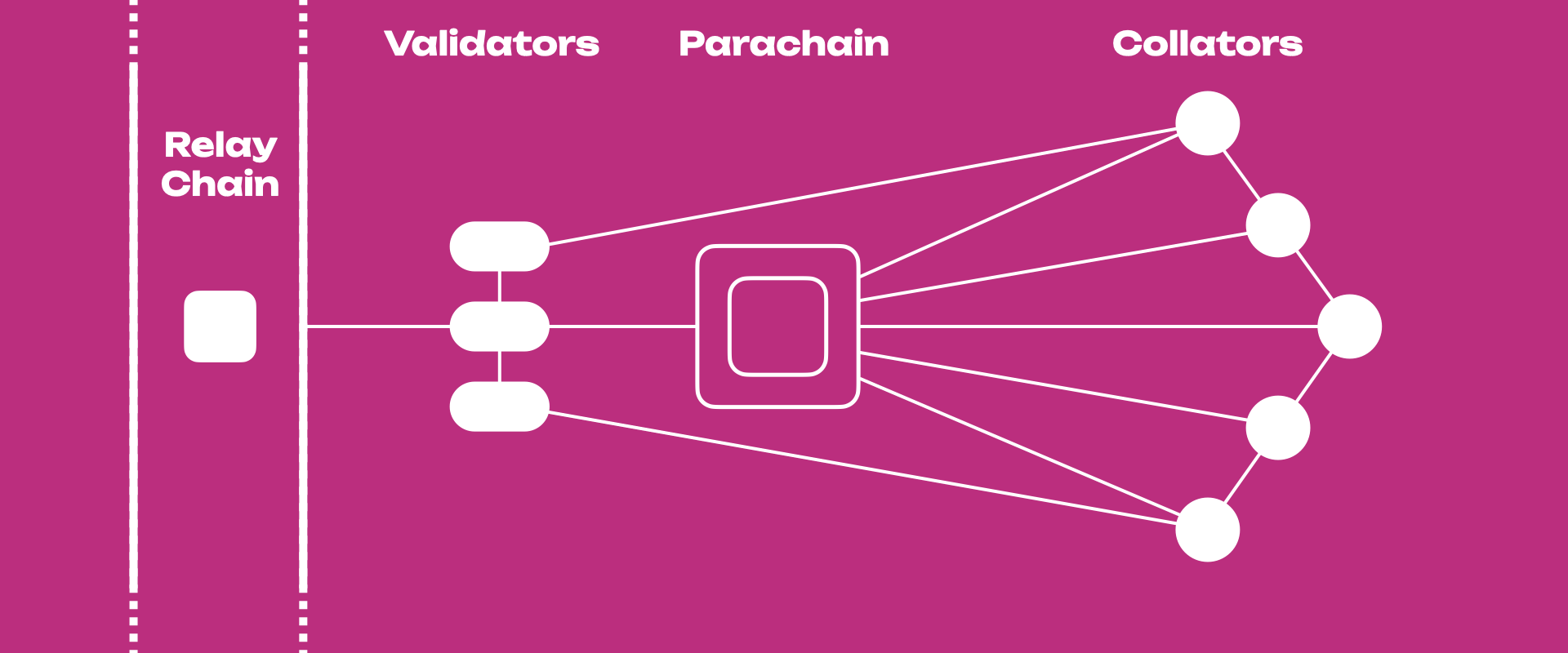

The heart of Polkadot is the Relay Chain—a central blockchain that acts as a coordinator for all connected chains. It handles security and finality but doesn't execute smart contracts itself.

Parachains and Parathreads

Parachains are specialized blockchains that are permanently connected to the Relay Chain. They receive a fixed "slot" and can write to every Relay Chain block. These slots are allocated through auctions where DOT tokens are bonded for the lease duration.

Parathreads are a more cost-effective alternative for projects with lower throughput. They pay per transaction and share Relay Chain capacity instead of renting a fixed slot.

DOT Token

DOT is Polkadot's native token and serves three main purposes:

Governance: Voting on network upgrades and parameters

Staking: Securing the Relay Chain through validators

Bonding: Reserving parachain slots through auctions

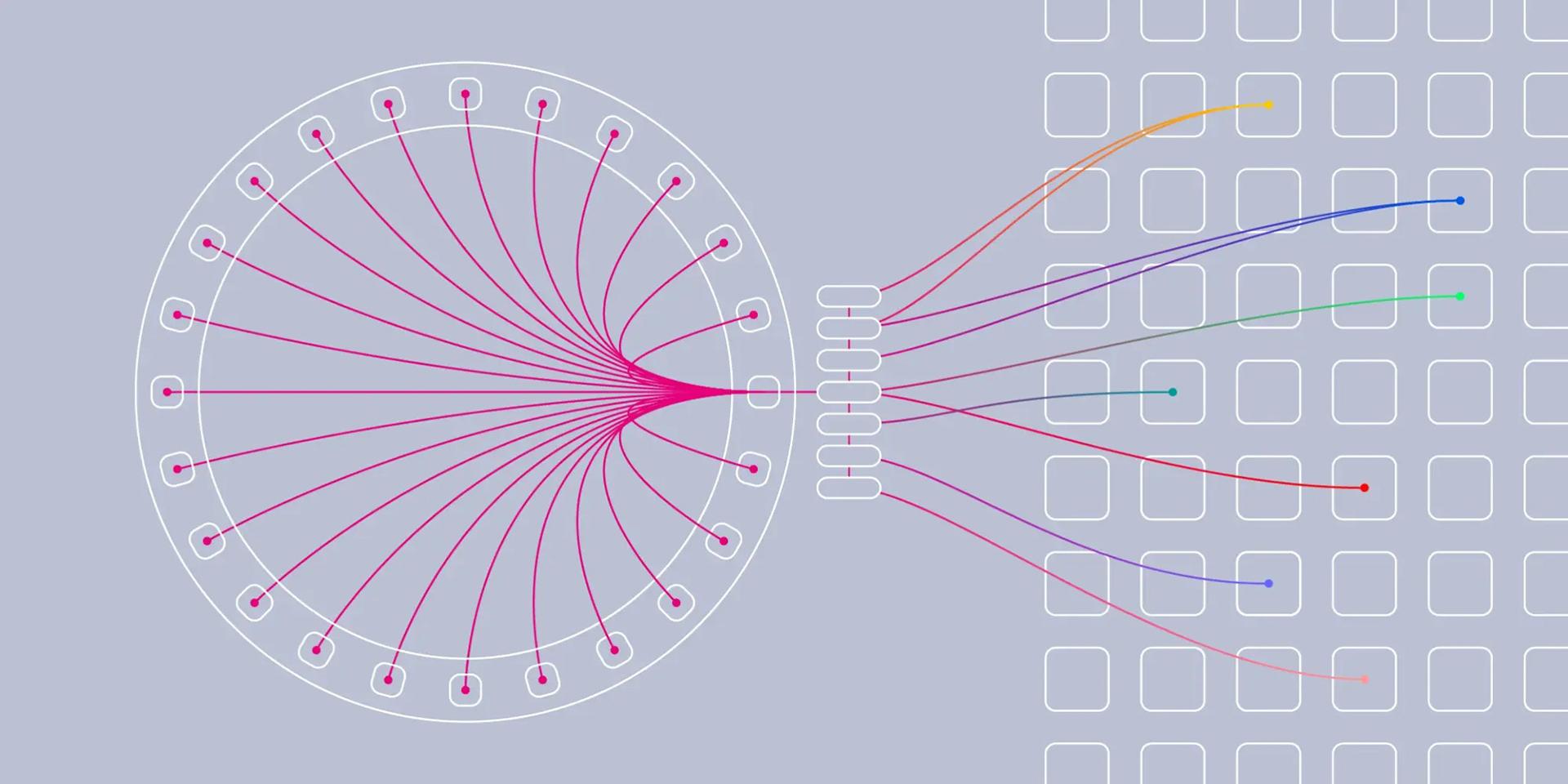

Interoperability

Polkadot's major advantage lies in native cross-chain communication. Since all parachains use the same Relay Chain as their security anchor, they can communicate with each other without external bridges or oracles.

This enables:

Cross-chain token transfers between parachains

Shared security for all connected chains

Parallel processing of different applications on specialized chains

For connections to external networks like Ethereum or Bitcoin, Polkadot uses specialized bridge parachains.

Staking and Governance

Polkadot uses Nominated Proof-of-Stake (NPoS) to secure the Relay Chain. There are two main roles:

Validators operate nodes, validate parachain blocks, and produce new Relay Chain blocks. They must stake a significant amount of DOT and face penalties for misbehavior.

Nominators select trustworthy validators and delegate their DOT tokens to them. They share both rewards and risks with their chosen validators.

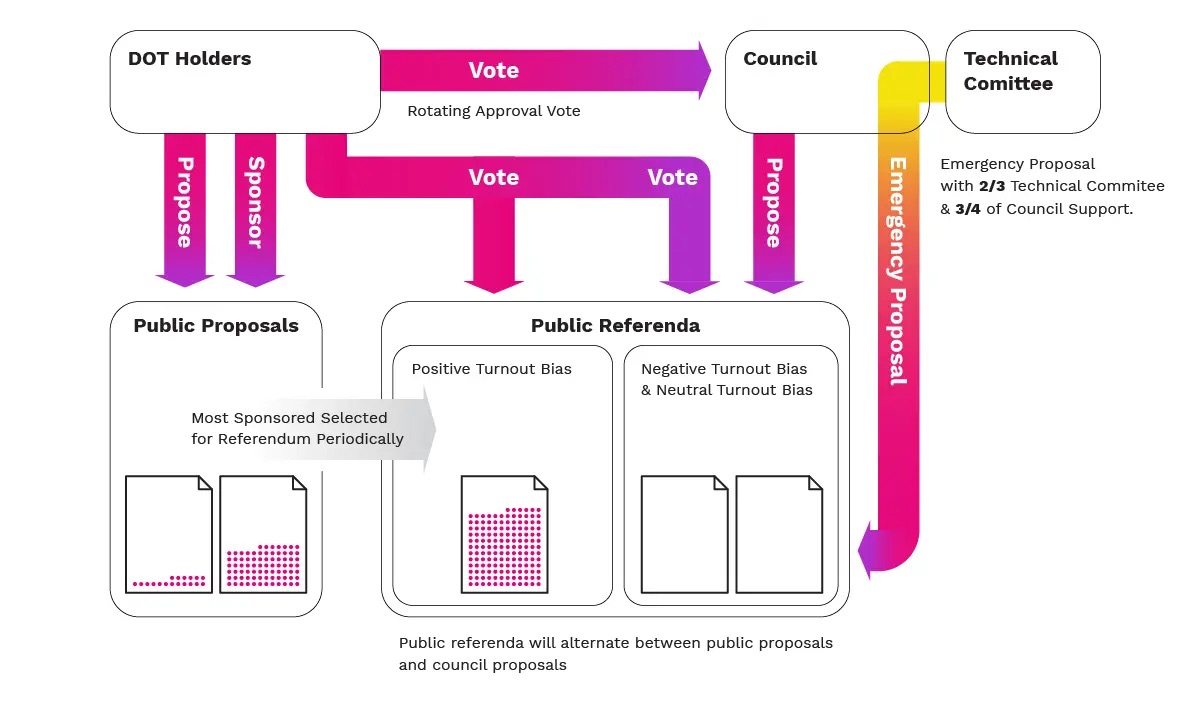

Governance without Forks

Polkadot features an on-chain governance system that enables network upgrades without hard forks. DOT holders can submit proposals and vote on them. An elected council coordinates the governance process and can make quick decisions during critical security issues.

Opportunities and Challenges

Opportunities

Polkadot addresses real problems in the blockchain landscape and offers a technically elegant solution. The Substrate framework makes it relatively easy to develop new blockchains that are directly Polkadot-compatible.

The shared security model could be particularly attractive for specialized applications that need their own chain but lack the resources for their own validator network.

Challenges

Strong competition: Cosmos, Avalanche Subnets, and Ethereum Layer-2 solutions offer similar functionality. Ethereum's rollup ecosystem has already gained significant traction.

Complexity: The parachain auction model is complex and expensive. Many projects prefer simpler alternatives like Ethereum L2s.

Adoption: Despite technical sophistication, Polkadot has achieved less developer adoption than hoped. However, over 60 parachains are currently active, and the implementation of Polkadot 2.0 with Elastic Scaling shows positive developments. Many parachain slots are now being replaced by the new Agile Coretime system.

Polkadot 2.0: The project involves a fundamental redesign with the JAM (Join-Accumulate Machine) protocol, which was already approved by the community in May 2024. Elastic Scaling was successfully implemented on Polkadot in May 2025, enabling parachains to utilize multiple cores simultaneously.

Conclusion

Polkadot remains a technically innovative project with a clear vision for multi-chain interoperability. The successful implementation of Polkadot 2.0 with Elastic Scaling in May 2025 and the community approval of JAM demonstrate that the project is making concrete progress. Success depends on whether it can attract more developers and projects to the ecosystem and compete against growing competition.

Frequently asked questions about Polkadot

What is the current price of Polkadot?

The current price of Polkadot is $1.28. Over the past 24 hours, the price is up 1.55%, with a trading volume of $56.04B. Polkadot is the 38th largest cryptocurrency by market cap, currently at $2.14B.

Is it worth investing in Polkadot?

The price change of Polkadot (DOT) over one year is currently -75.53%, making Polkadot a bad investment in hindsight. Whether this trend will continue in the future depends on many external factors such as supply and demand. Past price trends are no indicator of future performance.

Where can I buy Polkadot?

The best and most reputable crypto exchanges for buying Polkadot include ones such as Kraken and Coinbase. You can find more in our comparison of crypto exchanges.

Which Polkadot wallet is the best?

The best hardware wallets for Polkadot are Ledger Nano X, BitBox02 and Trezor Model T. In our opinion, the best software wallet for Polkadot is the Zengo app. You can find more in our comparison of crypto wallets.

What was the all-time high of Polkadot?

The Polkadot (DOT) cryptocurrency all-time high is $54.98. This price was reached on Nov 04, 2021. The current price is $1.28, a difference of -97.67% from the all-time high.

Who has invested in Polkadot?

Polkadot's early investors include institutional investors and venture capitalists (VCs) such as 1Confirmation, Boost VC, Digital Currency Group, Blockchain Capital, Coin Fund, Arrington XRP Capital.

How many Polkadot (DOT) are currently in circulation?

There are currently 1.66B Polkadot (DOT) in circulation. The total amount of DOT in circulation represents all coins and tokens that have already been distributed and are therefore held in the wallets of private individuals, companies or institutions.