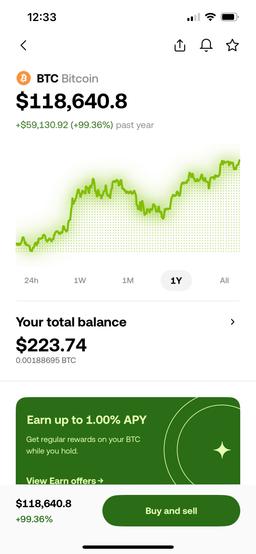

Which crypto exchange has the lowest fees?

Crypto exchanges with low fees are especially important for users who trade frequently and want to keep their transaction costs as low as possible. In our fee comparison, we highlight the cheapest platforms for buying and selling cryptocurrencies.

Table of contents

Key facts at a glance

Bitget and Binance are among the lowest-fee crypto exchanges, with trading fees starting at just 0.1%. Bitvavo also offers low fees between 0.15% and 0.25%, plus extra benefits such as a European location and beginner-friendly interface.

Trading fee comparison – cheapest crypto exchanges

The cheapest crypto exchange: Bitget

With a rating of 8.2 out of 10, Bitget is not only our top pick for crypto trading but also the lowest-cost exchange currently available. Bitget offers extremely competitive trading fees from 0.0125% to 0.1%, making it a popular choice among active traders.

Why low fees matter

Low trading fees benefit everyone — especially over the long run, where even small percentages can have a big impact. The difference between the cheapest and most expensive exchange can quickly add up through spreads and hidden charges.

Low-fee exchanges are especially valuable if you:

Trade with large amounts

Buy and sell crypto frequently

Use high-frequency or short-term strategies (e.g. scalping)

Trading large amounts

When trading significant capital, fees become a key selection criterion. Even small differences in percentages can lead to major cost differences — especially if you rebalance or adjust your portfolio frequently.

Frequent trading

If you buy, sell, or swap cryptocurrencies often, transaction fees add up over time. While some fees are clearly displayed, others are hidden. The more you trade, the more important it is to minimize costs.

Professional trading

If you’re a professional trader, low fees are crucial. Many trading strategies — like scalping — rely on making multiple trades quickly and cheaply. High fees can erase your profits or make your strategy unviable.

Hidden fees on crypto exchanges

Even if trading fees are advertised upfront, many platforms charge additional fees that aren’t always obvious. Before signing up, be sure to check for:

Deposit and withdrawal fees: May vary by crypto, fiat currency, or network.

Spreads: The difference between the buy and sell price. A wide spread means you get less value.

Inactivity fees: Charged on accounts that go unused for a certain time.

Overnight fees: If you use leveraged products, holding positions overnight can incur extra charges.

Margin fees: If you trade on margin, interest and holding costs may apply.

Features that also matter

Besides low fees, different exchanges offer different features. There’s no one-size-fits-all solution — it depends on your individual needs and what you plan to use the platform for.

DCA plan

Staking

Real crypto

Self-custody

Trading tools

Conclusion

There’s often a pattern when it comes to crypto exchanges: The more beginner-friendly the platform, the higher the fees tend to be.

If you’re willing to spend some time learning how a more advanced exchange works, you can save significantly on trading fees — especially if you trade frequently. Over the long term, those savings can really add up.

About the author

Hi, I'm Philipp. 👋

Founder coinbird.com

With over 15 years of experience in the IT sector, I love building easy-to-use digital products that actually help people. In 2017, I fell down the Bitcoin rabbit hole and gradually realized that the crypto world lacked simple, user-friendly tools for everyday people. That’s why I created coinbird.com – to make crypto easier to understand, more accessible, and transparent.

LinkedIn